Wingtech shares plunge after Dutch government intervenes in chip unit

NegativeFinancial Markets

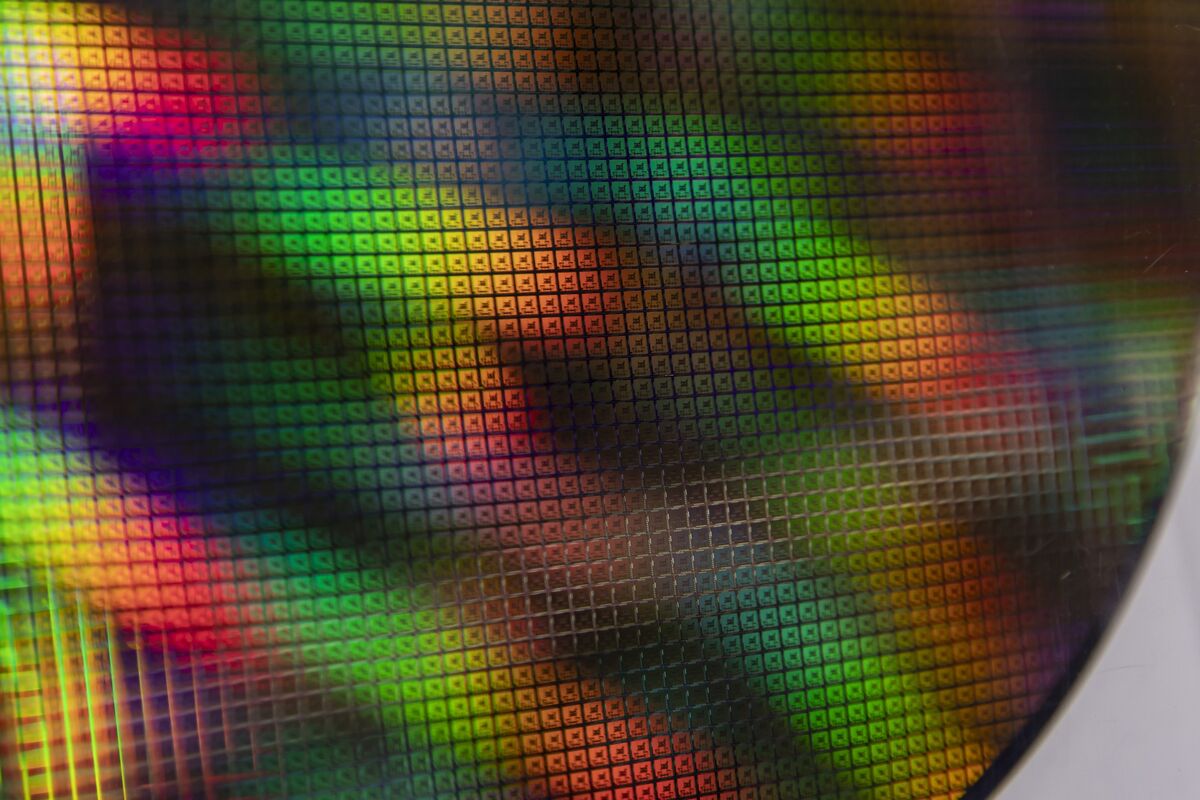

Wingtech's shares have taken a significant hit following intervention by the Dutch government in its chip unit. This move raises concerns about the stability of the semiconductor industry, which is crucial for technology and manufacturing sectors. Investors are worried about potential regulatory challenges and the impact on Wingtech's operations, making this a critical moment for the company and its stakeholders.

— Curated by the World Pulse Now AI Editorial System