Ridgemont Equity Collects Nearly $4 Billion for Latest Fund

PositiveFinancial Markets

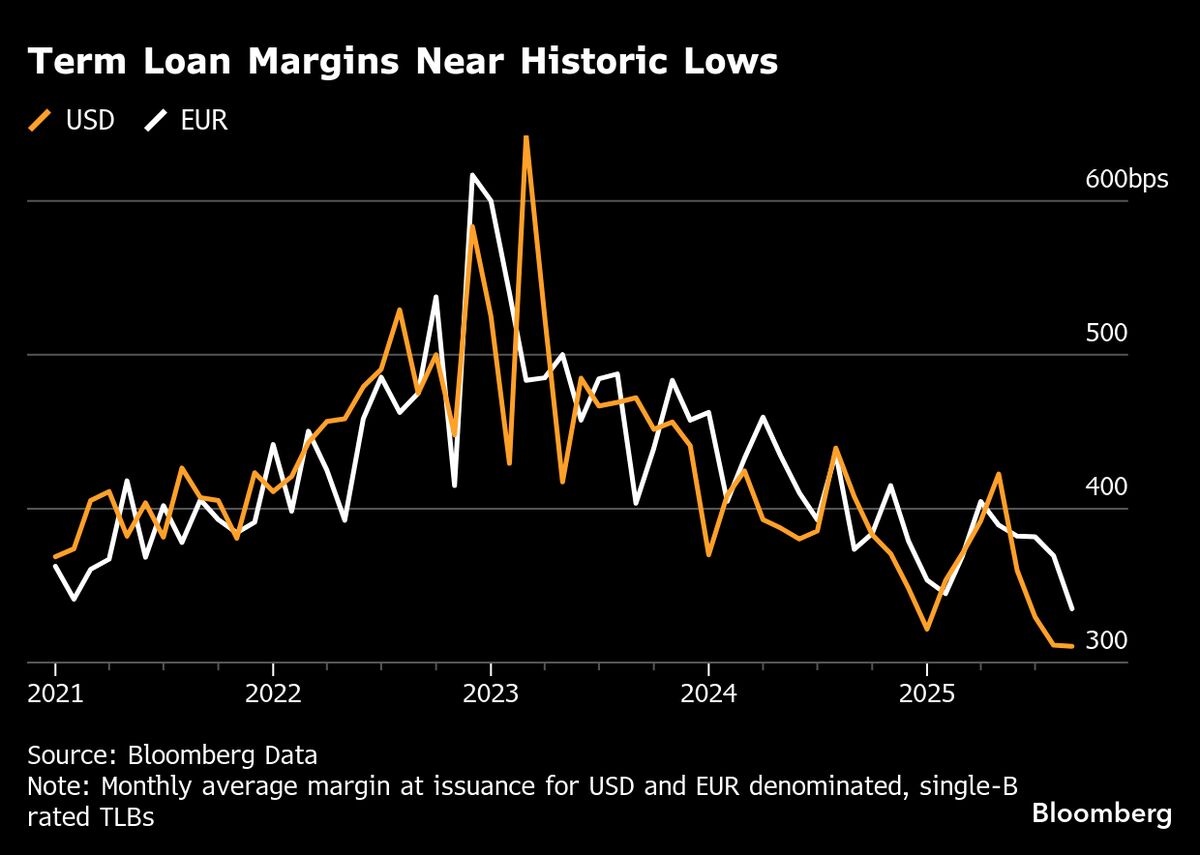

Ridgemont Equity has successfully raised nearly $4 billion for its latest fund, surpassing its target size even amid a general slowdown in private-equity fundraising. This achievement highlights Ridgemont's strong position in the market and investor confidence in their strategy, which is crucial for driving future investments and growth.

— Curated by the World Pulse Now AI Editorial System