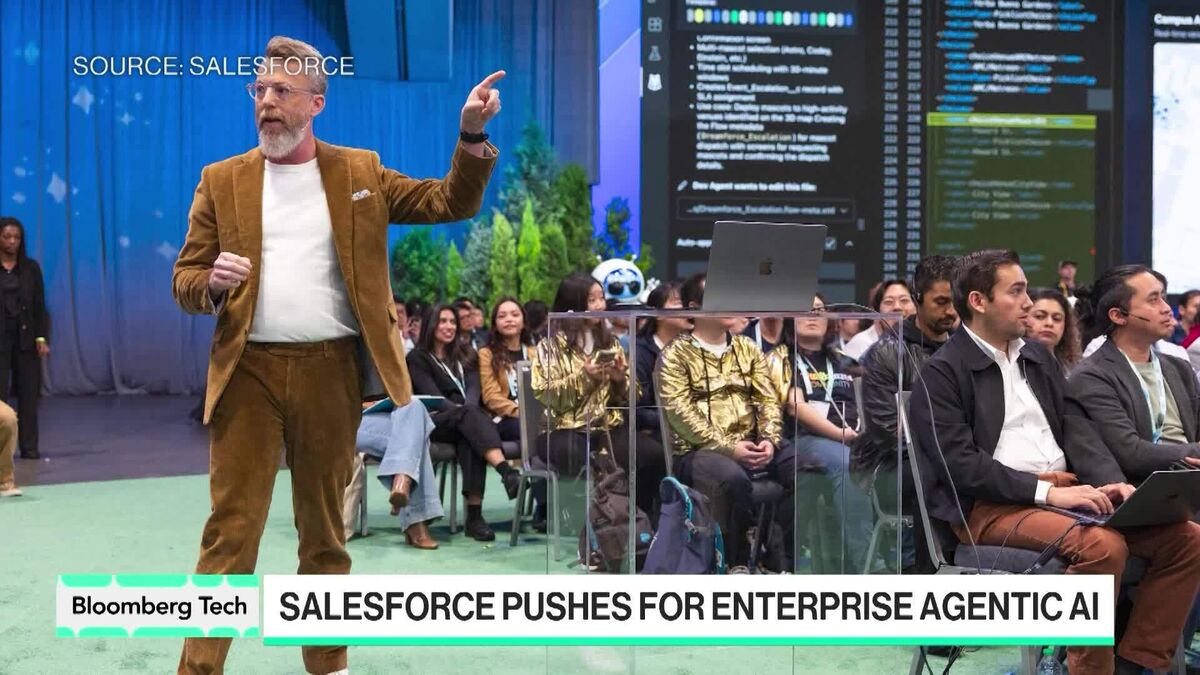

Salesforce forecasts stronger-than-expected revenue of over $60 billion in 2030

PositiveFinancial Markets

Salesforce has announced a forecast for its revenue to exceed $60 billion by 2030, which is significantly higher than previous expectations. This optimistic outlook reflects the company's strong growth trajectory and its ability to adapt to market demands. Such a forecast is important as it not only boosts investor confidence but also highlights Salesforce's position as a leader in the tech industry, paving the way for future innovations and expansions.

— Curated by the World Pulse Now AI Editorial System