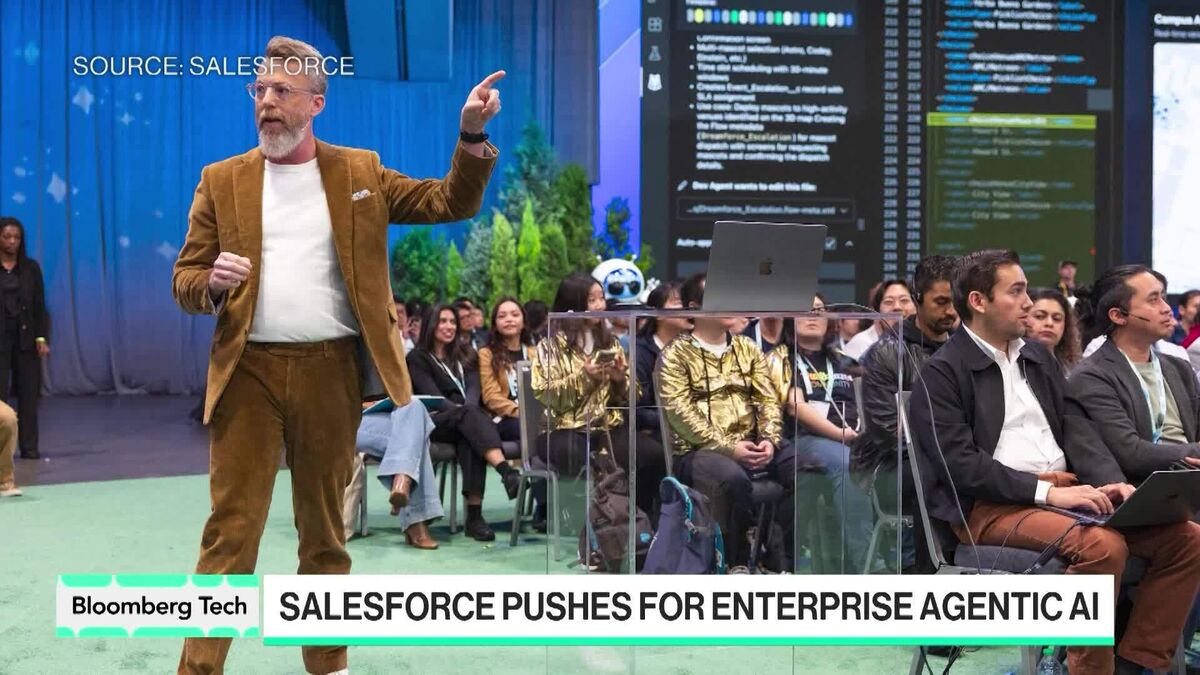

Convincing Enterprise to Invest in AI

PositiveFinancial Markets

Rebecca Wettemann, CEO of Valoir, emphasizes the importance of demonstrating the value of AI products to enterprise customers rather than just discussing their benefits. This insight comes during her conversation with Caroline Hyde on Bloomberg Tech, highlighting Salesforce's efforts to push AI solutions. This matters because as AI continues to evolve, showing tangible benefits can significantly influence enterprise adoption and investment in these technologies.

— Curated by the World Pulse Now AI Editorial System