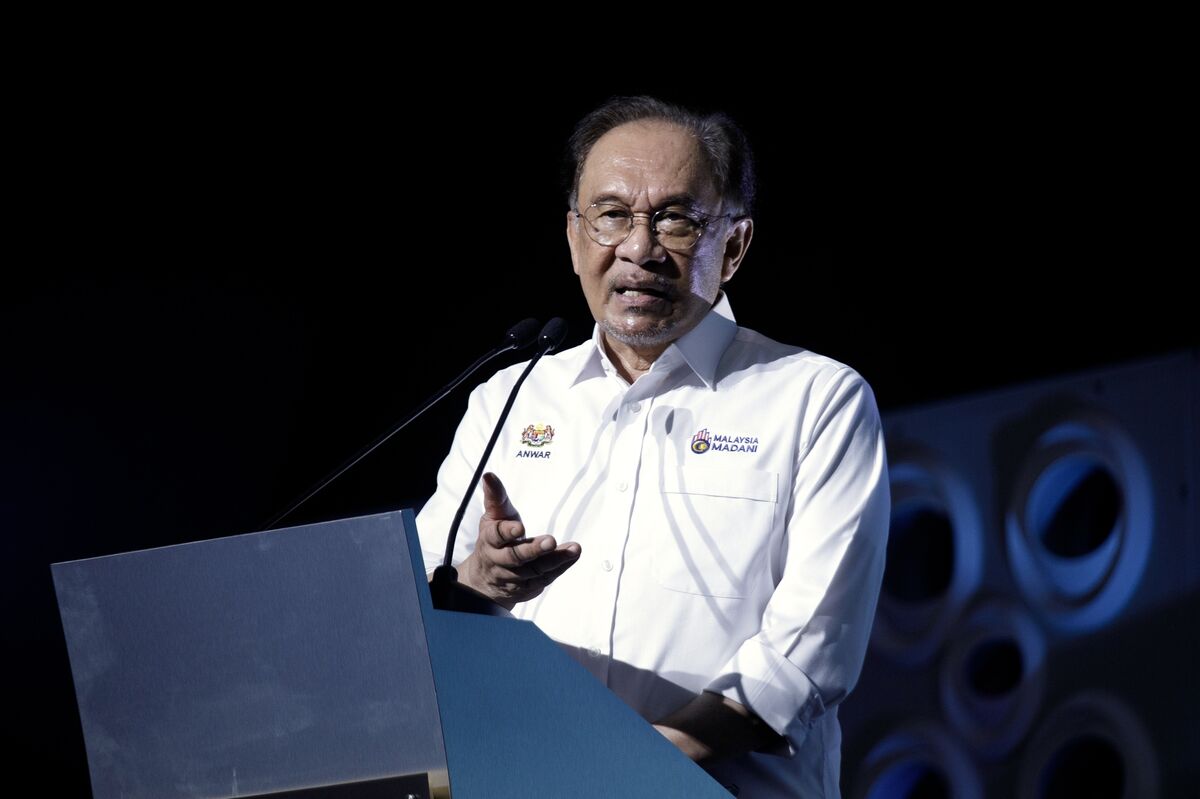

Malaysia’s 2026 Budget to Give Markets a Boost, Analysts Say

PositiveFinancial Markets

Analysts are optimistic about Malaysia's 2026 budget, predicting it will positively impact local markets. The absence of negative surprises in the spending plan is seen as a reassuring sign for investors, suggesting stability and potential growth in the economy.

— Curated by the World Pulse Now AI Editorial System