Macron reappoints Sébastien Lecornu as French prime minister

PositiveFinancial Markets

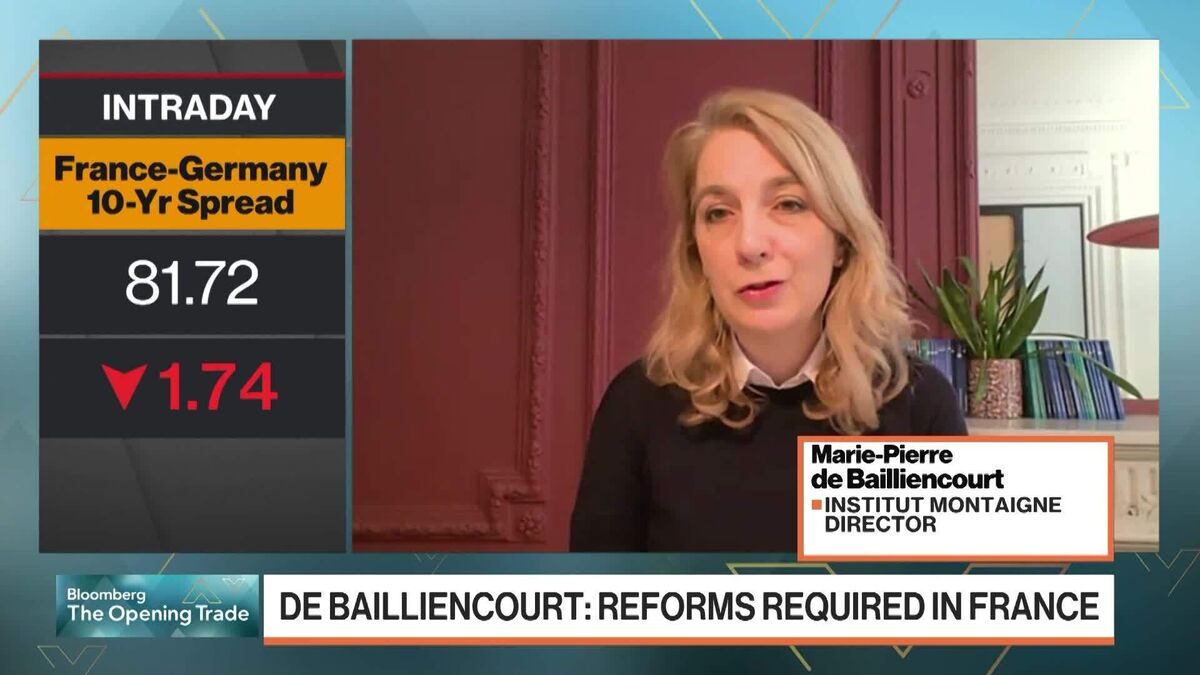

French President Emmanuel Macron has reappointed Sébastien Lecornu as Prime Minister, signaling a commitment to advance the government's agenda, particularly in finalizing the budget for 2026. This decision is significant as it reflects Macron's confidence in Lecornu's leadership during a crucial period for the country's financial planning.

— Curated by the World Pulse Now AI Editorial System