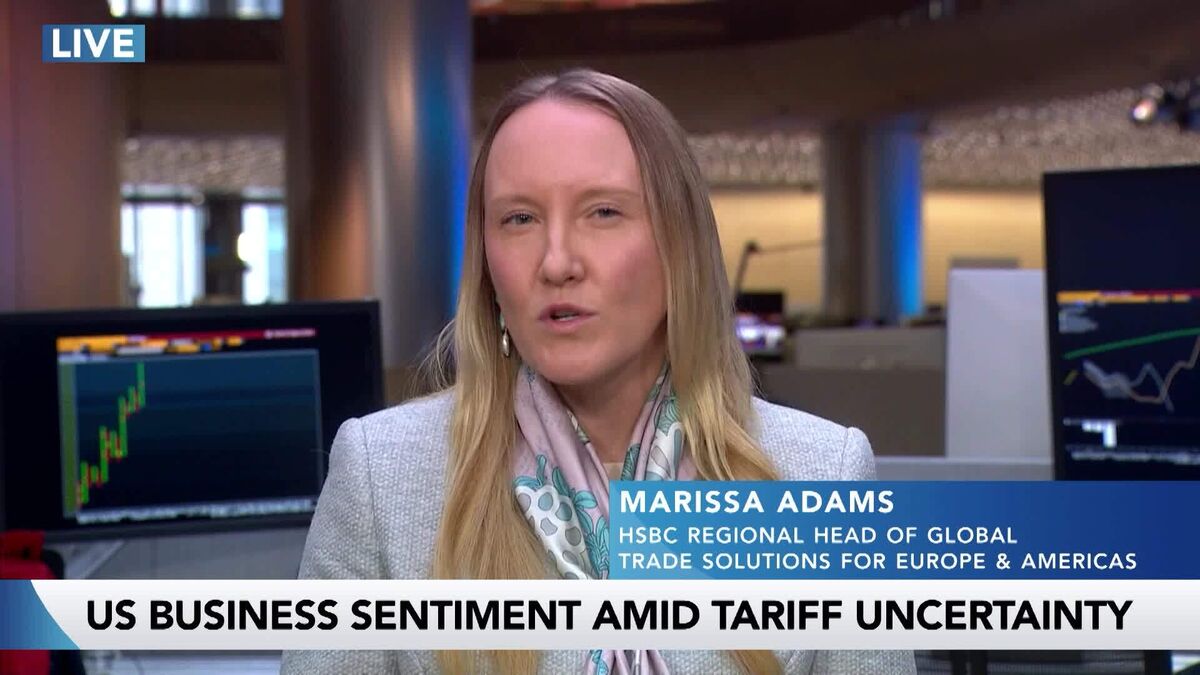

Optimism Among US Corporates on Trade: Adams

PositiveFinancial Markets

- Marissa Adams, HSBC's Regional Head of Global Trade Solutions for Europe and Americas, expressed optimism regarding the growth of international trade among US companies during an interview with Bloomberg. She highlighted that US corporates are more positive about trade prospects compared to their global counterparts, indicating a potential shift in trade dynamics.

- This optimism is significant for HSBC as it reflects the bank's strategic focus on supporting trade solutions in key markets. A positive outlook on trade can enhance HSBC's business opportunities and strengthen its position in the global market.

- The sentiment around trade is echoed by broader trends in investment, particularly in emerging markets like Africa, where global investors are increasingly drawn by natural resources. Additionally, the anticipated changes in interest rates may influence market conditions, affecting corporate strategies and investment decisions across various sectors.

— via World Pulse Now AI Editorial System