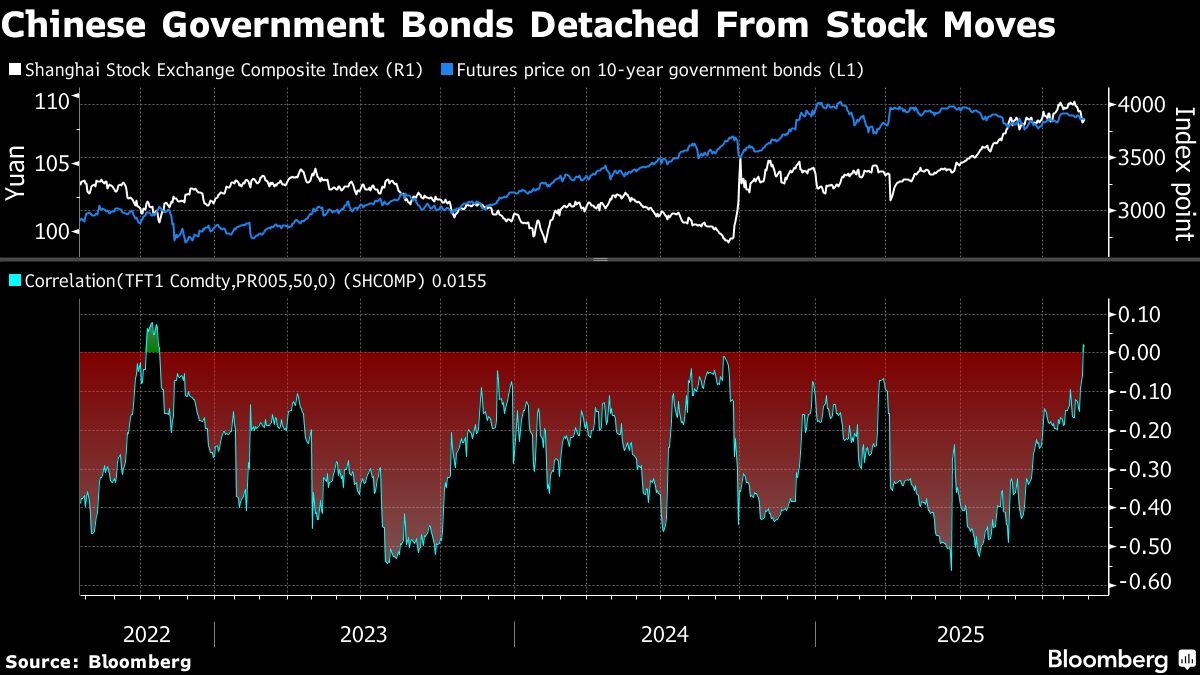

Chinese Bonds See No Haven Demand From Stock Losses on PBOC Bets

NegativeFinancial Markets

- China's stock and bond markets are showing signs of decoupling, as the traditional inverse correlation between equities and debt is breaking down. Recent market dynamics indicate that expectations of monetary easing by the People's Bank of China (PBOC) are not driving bond prices higher despite stock losses.

- This shift is significant as it reflects changing investor sentiment and market behavior, suggesting that the bond market may not serve as a safe haven during stock market downturns, which could impact investment strategies and risk assessments.

- The broader implications of this decoupling highlight ongoing economic challenges in China, including a downturn in investment and concerns over the technology sector, which has seen declines amid fears of market volatility. This situation raises questions about the overall health of China's economy and its ability to attract foreign investment.

— via World Pulse Now AI Editorial System