Fed cuts interest rates by a quarter point amid apparent split over US economy

NegativeFinancial Markets

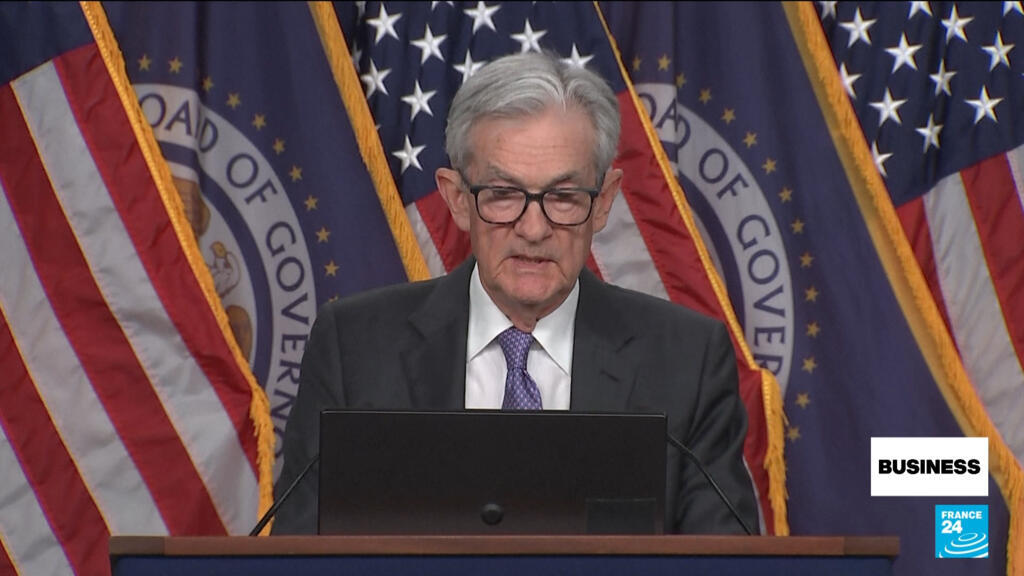

- The US Federal Reserve has cut interest rates by a quarter point for the third time this year, reflecting a split among committee members on how to address ongoing economic challenges, including tariffs and inflation. The decision was made during a divisive nine-to-three vote, indicating a departure from the usual consensus within the Federal Open Market Committee.

- This interest rate cut is significant as it aims to stimulate economic growth amid uncertainty. Fed Chair Jerome Powell has stressed the importance of unity in decision-making, yet the split vote suggests differing views on the best path forward for the economy.

- The backdrop of this decision includes President Trump's ongoing criticism of Powell and the Fed's management of interest rates, as well as concerns about inflation and potential recession. The Fed's cautious approach signals a complex economic landscape, where external pressures and internal disagreements may influence future monetary policy.

— via World Pulse Now AI Editorial System