Allies of Federal Reserve Chair Jerome Powell have laid the groundwork for him to push a rate cut through a divided committee at December’s meeting even though it could draw multiple dissents

NeutralFinancial Markets

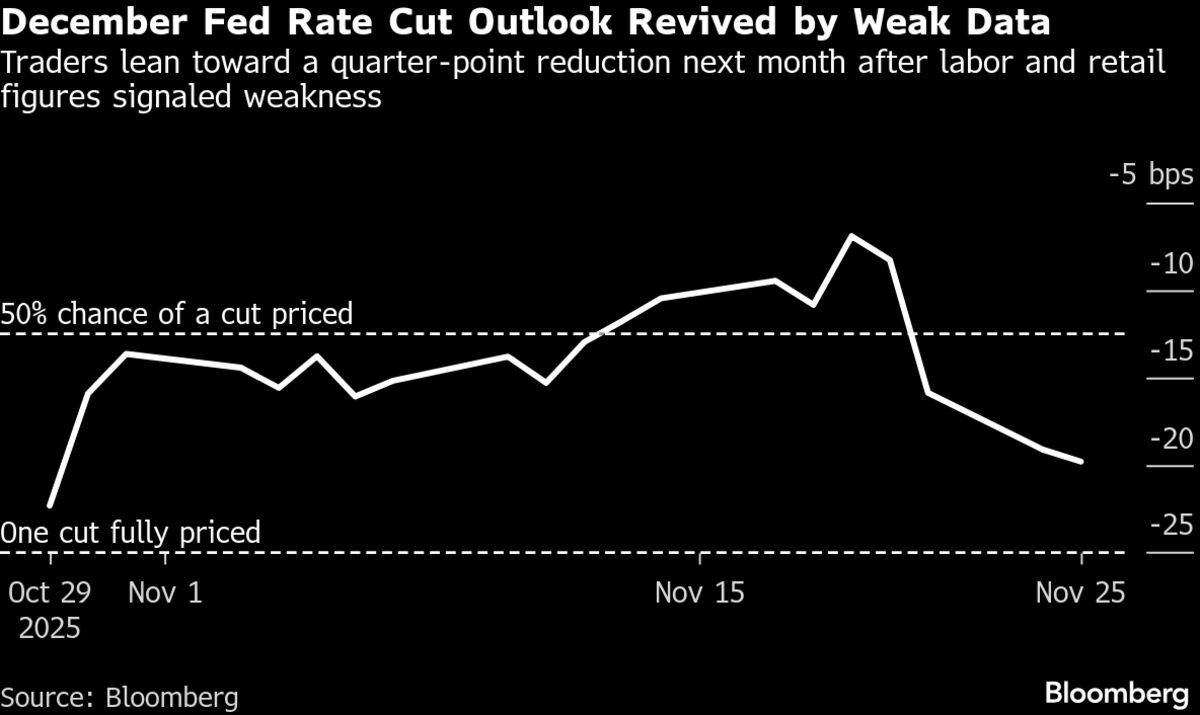

- Allies of Federal Reserve Chair Jerome Powell have set the stage for a potential interest rate cut at the upcoming December meeting, despite the committee's divisions and the risk of dissenting opinions. This decision comes amid concerns about economic indicators, including inflation and labor market conditions, which complicate the Fed's policy-making process.

- The possibility of a rate cut is significant as it reflects the Fed's response to ongoing economic challenges, including a weakening labor market and rising inflation. A rate reduction could stimulate economic growth, but it also raises questions about the Fed's ability to balance its dual mandate of promoting maximum employment and stable prices.

- The internal divisions within the Federal Reserve highlight a broader debate over monetary policy direction, as officials grapple with conflicting economic signals. While some members advocate for rate cuts to support growth, others express caution due to inflationary pressures, indicating a complex landscape for future monetary policy decisions.

— via World Pulse Now AI Editorial System