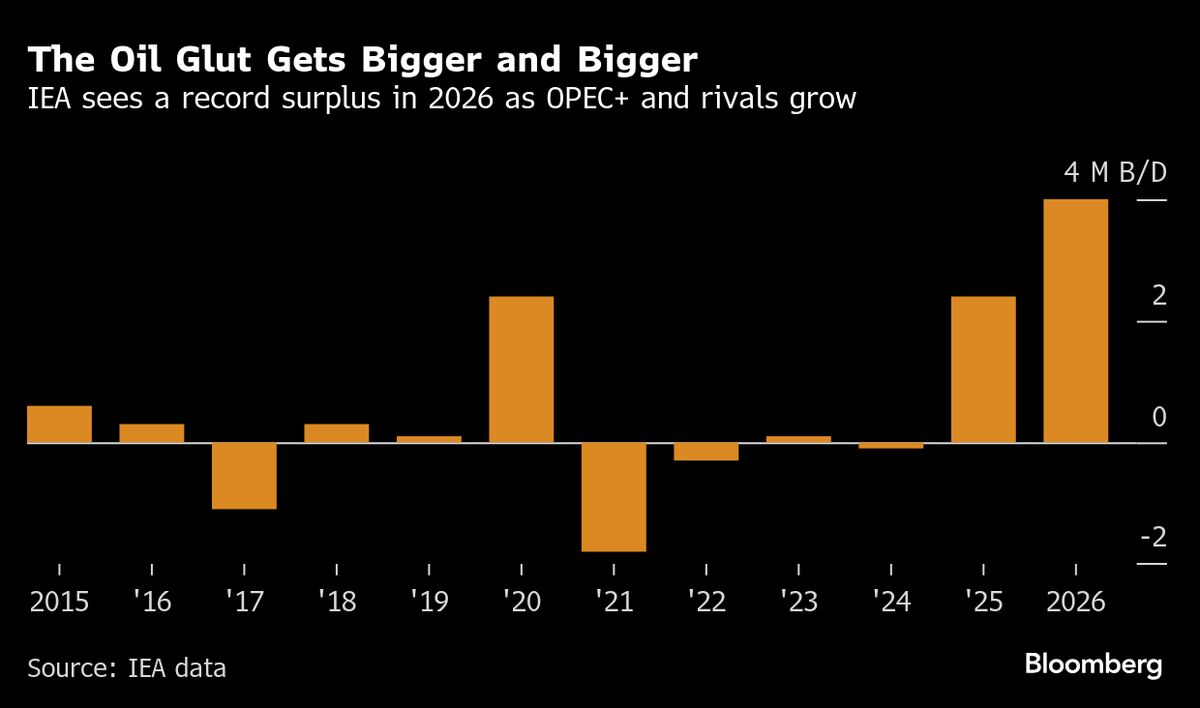

Wall Street Sees Modest Oil Price Decline Next Year on Surplus

NegativeFinancial Markets

- Wall Street analysts predict a modest decline in oil prices for the upcoming year, attributing this trend to a surplus in the market. This follows a challenging year for oil prices, which have seen significant drops since the pandemic, indicating that the selling pressure may continue.

- The anticipated decline in oil prices raises concerns for major oil companies, including Petrobras, which recently announced a $109 billion spending plan. The ability of such companies to maintain dividend payments may be jeopardized as they navigate through declining oil revenues.

- The broader oil market is currently experiencing volatility, with Saudi Arabia recently cutting its main oil price to a five-year low amid surplus conditions. This situation reflects ongoing challenges in the global oil supply chain, as traders remain cautious about future price stability.

— via World Pulse Now AI Editorial System