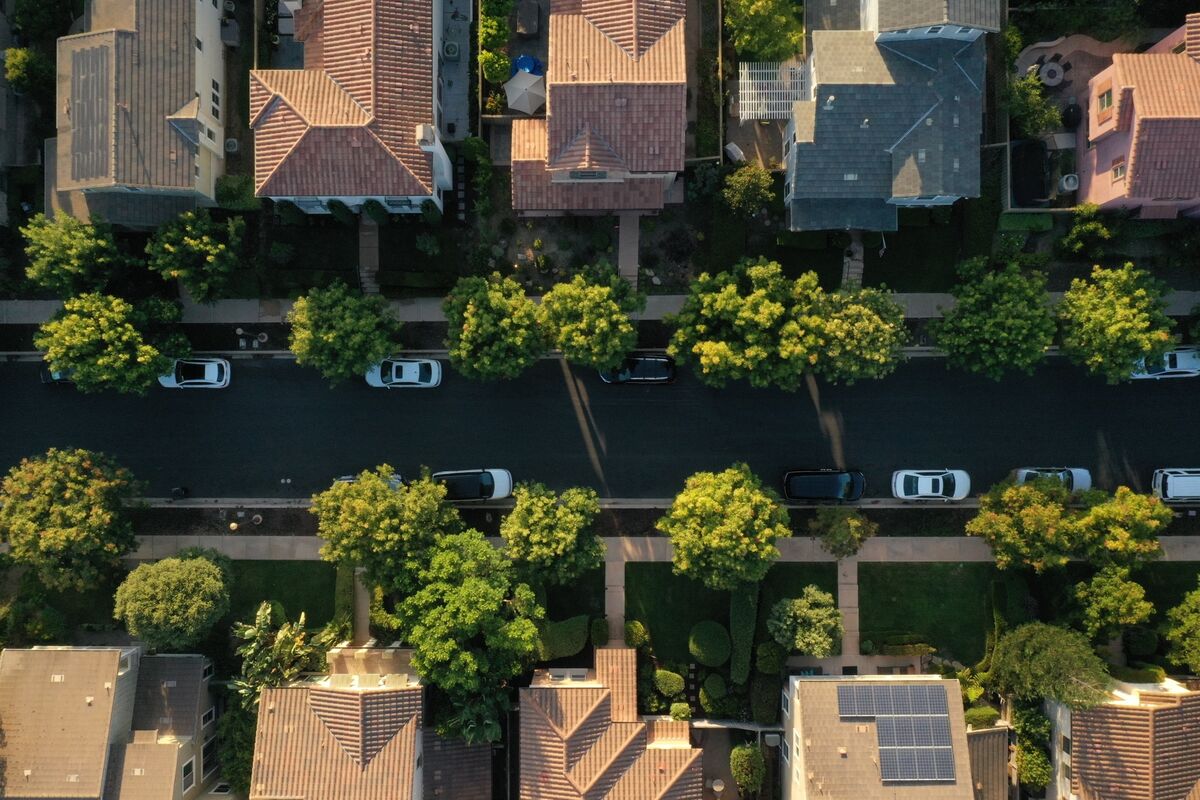

Lennar Forecast Disappoints in Challenging Market for Builders

NegativeFinancial Markets

Lennar Corp. has reported a disappointing forecast for quarterly home orders, falling short of analysts' expectations. This news highlights the ongoing challenges in the housing market, driven by affordability issues and an uncertain job market, which are dampening buyer demand. Understanding these trends is crucial for potential homebuyers and investors alike, as they navigate a complex economic landscape.

— Curated by the World Pulse Now AI Editorial System