China to Smooth Gold Imports as Prices Soar and Yuan Rallies

PositiveFinancial Markets

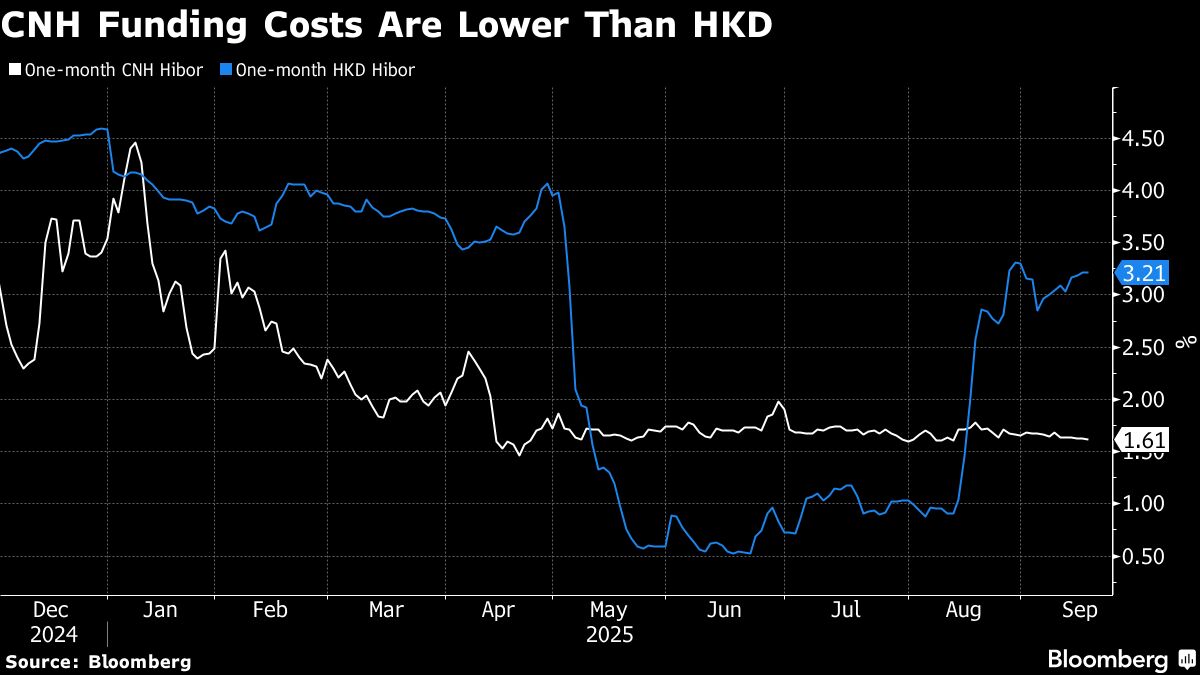

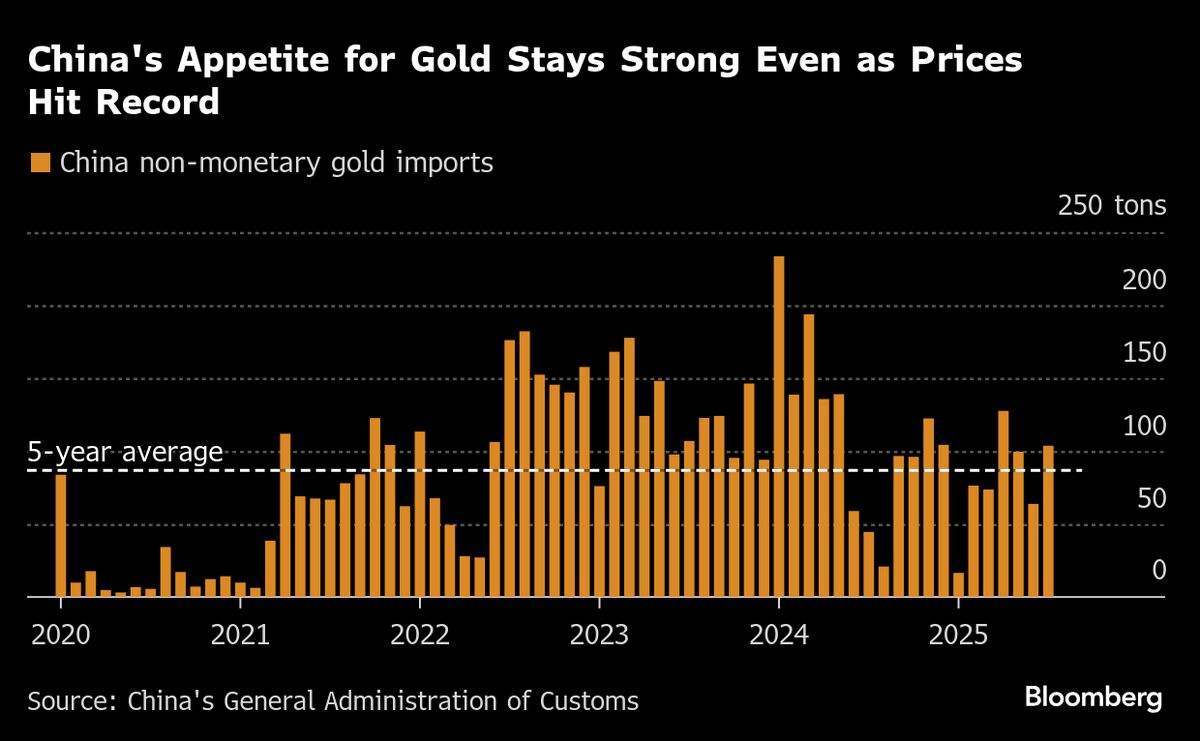

China's central bank is set to ease restrictions on gold imports, a move that could significantly liberalize the world's largest bullion market. This decision comes as gold prices soar and the yuan strengthens, indicating a potential shift in China's approach to gold trading. By allowing more imports, China aims to enhance market dynamics and provide investors with greater access to gold, which is crucial for both economic stability and investment diversification.

— Curated by the World Pulse Now AI Editorial System