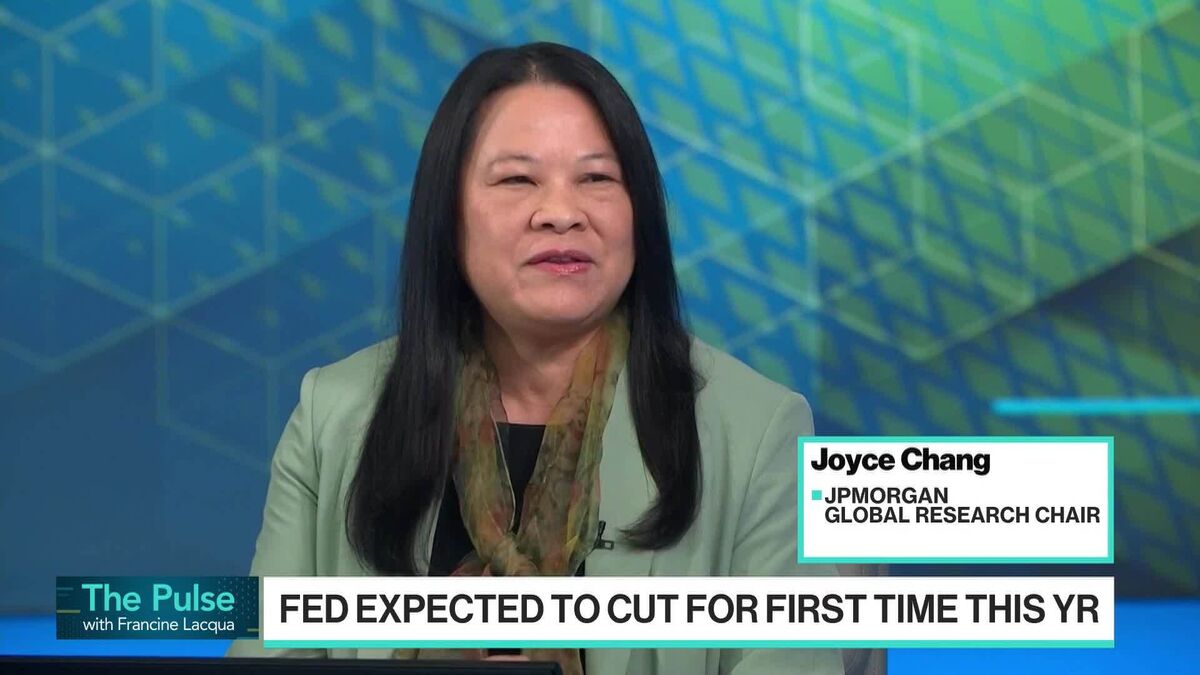

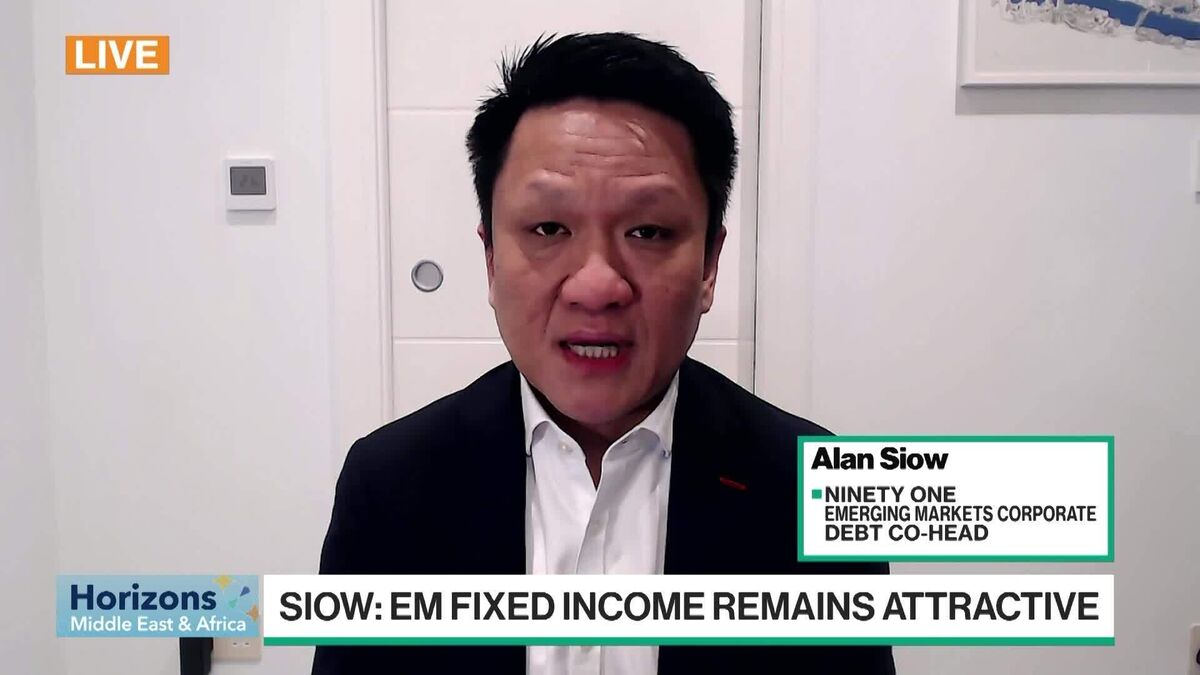

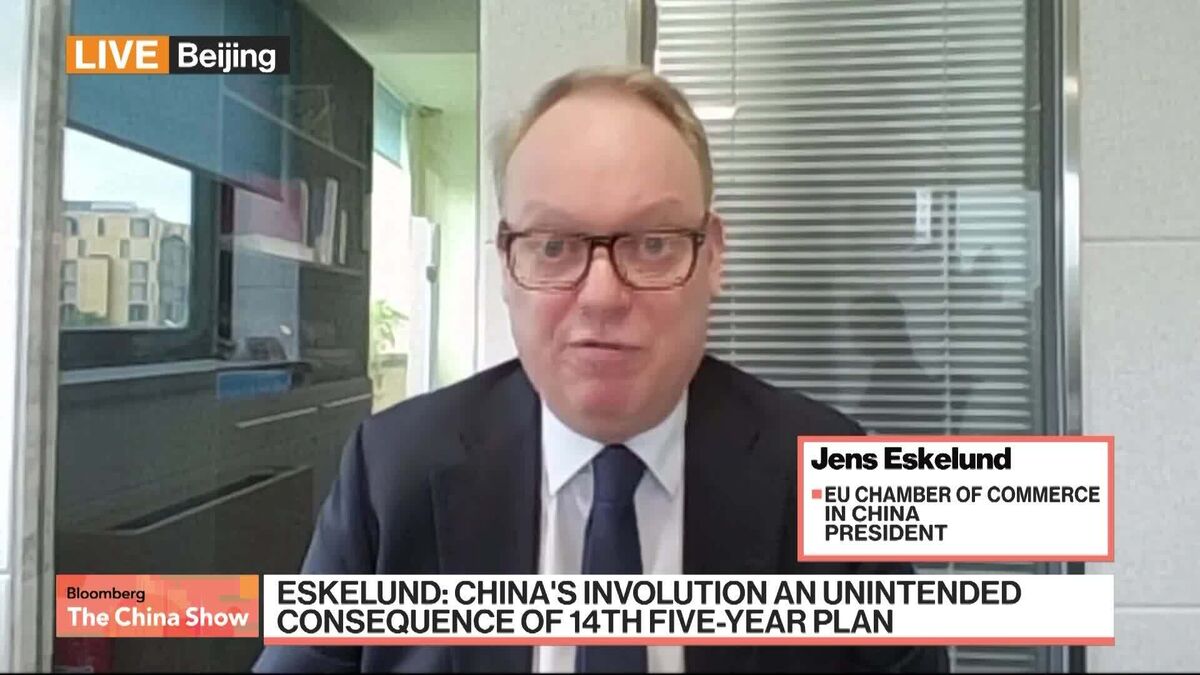

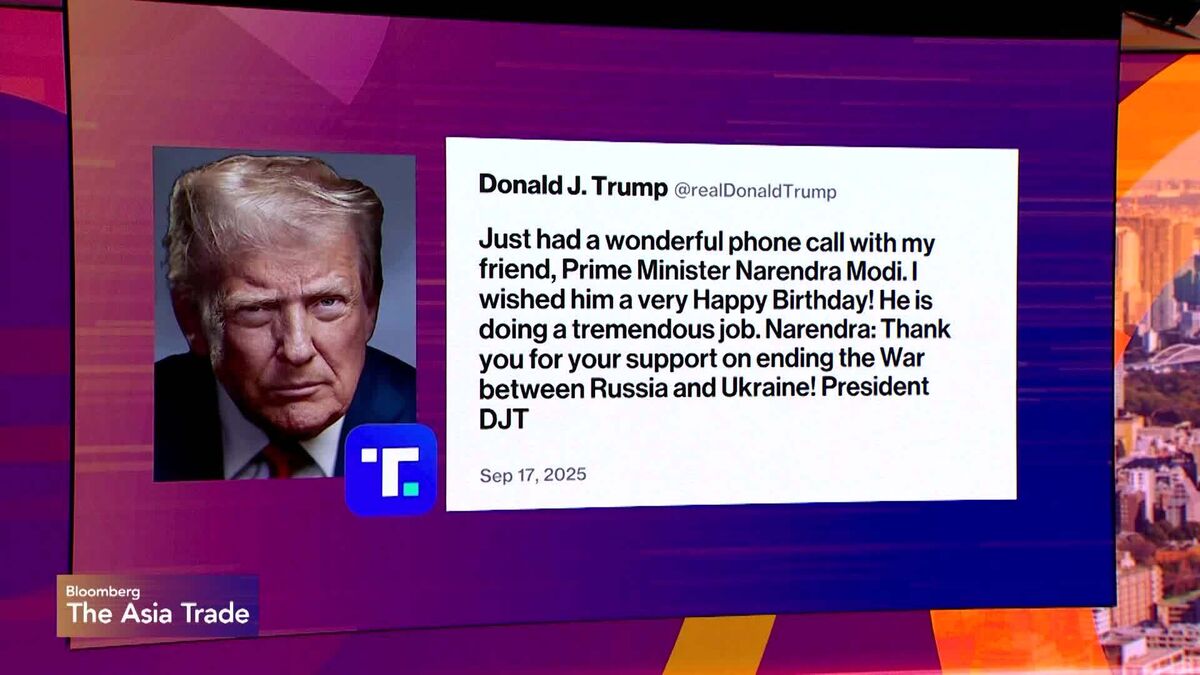

Horizons Middle East & Africa 9/17/2025

PositiveFinancial Markets

Horizons Middle East & Africa is set to be a daily highlight for anyone interested in one of the world's most dynamic regions. Broadcasting live from Dubai, it offers the latest insights into global markets and features engaging interviews, all tailored for audiences in the Gulf, Hong Kong, London, and Johannesburg. This initiative not only keeps viewers informed but also emphasizes the importance of the MEA region in the global economy.

— Curated by the World Pulse Now AI Editorial System