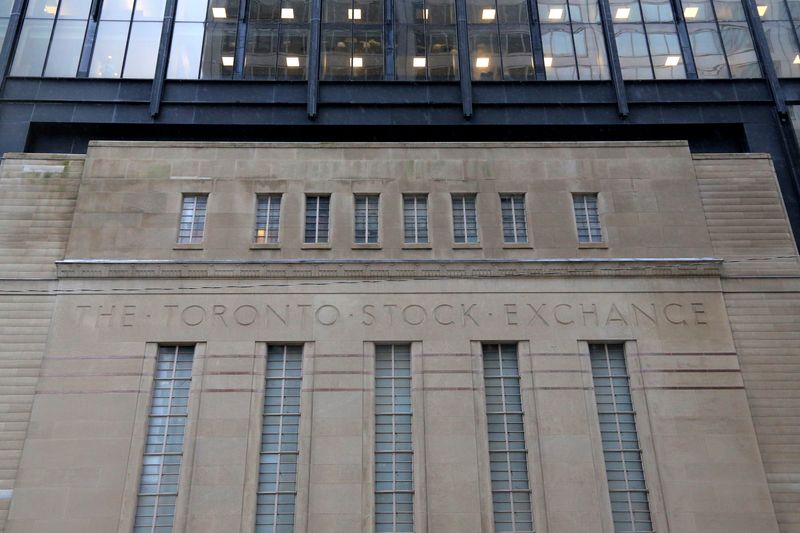

Mining stocks rise as gold hits new record high

PositiveFinancial Markets

Mining stocks are experiencing a significant rise as gold prices reach a new record high. This surge is important because it reflects growing investor confidence in precious metals, often seen as a safe haven during economic uncertainty. As gold continues to climb, mining companies are likely to benefit, potentially leading to increased investments and job creation in the sector.

— Curated by the World Pulse Now AI Editorial System