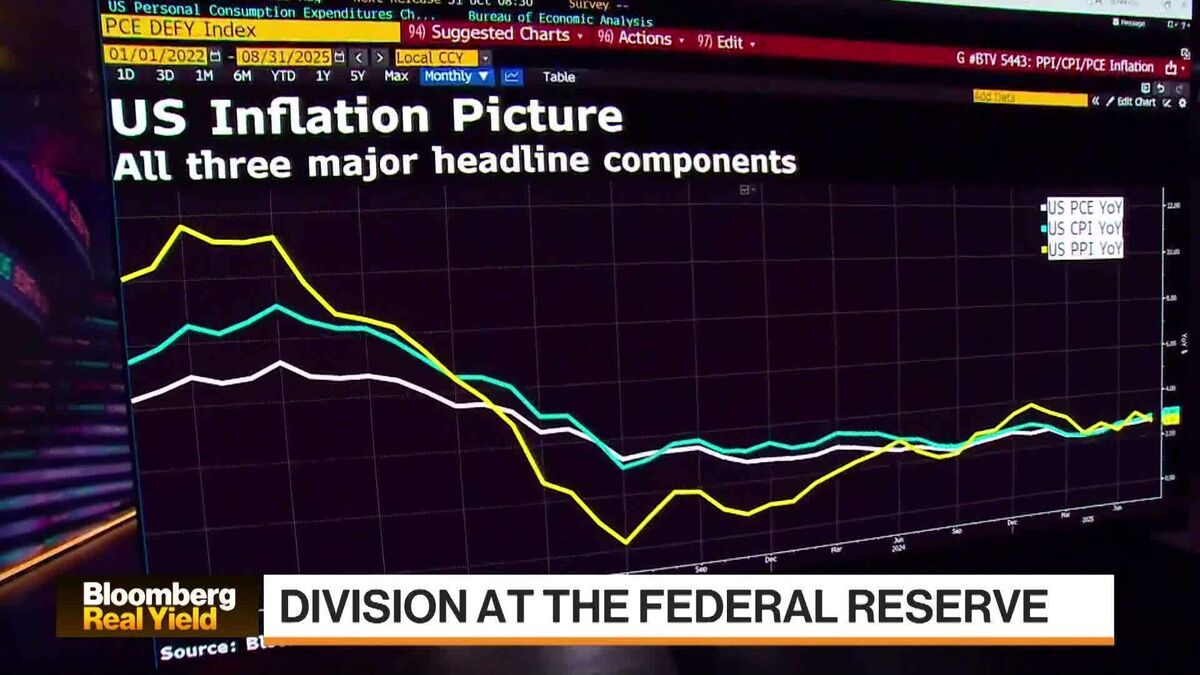

Treasury Yields Close Week Higher as Traders Shift Focus to Jobs

NeutralFinancial Markets

Treasury yields have closed the week at their highest levels in almost a month, signaling a shift in investor focus towards upcoming labor market data. This data is crucial as it could influence the Federal Reserve's decisions on interest rates, making it a key moment for the economy. Understanding these trends helps investors navigate potential changes in the financial landscape.

— Curated by the World Pulse Now AI Editorial System