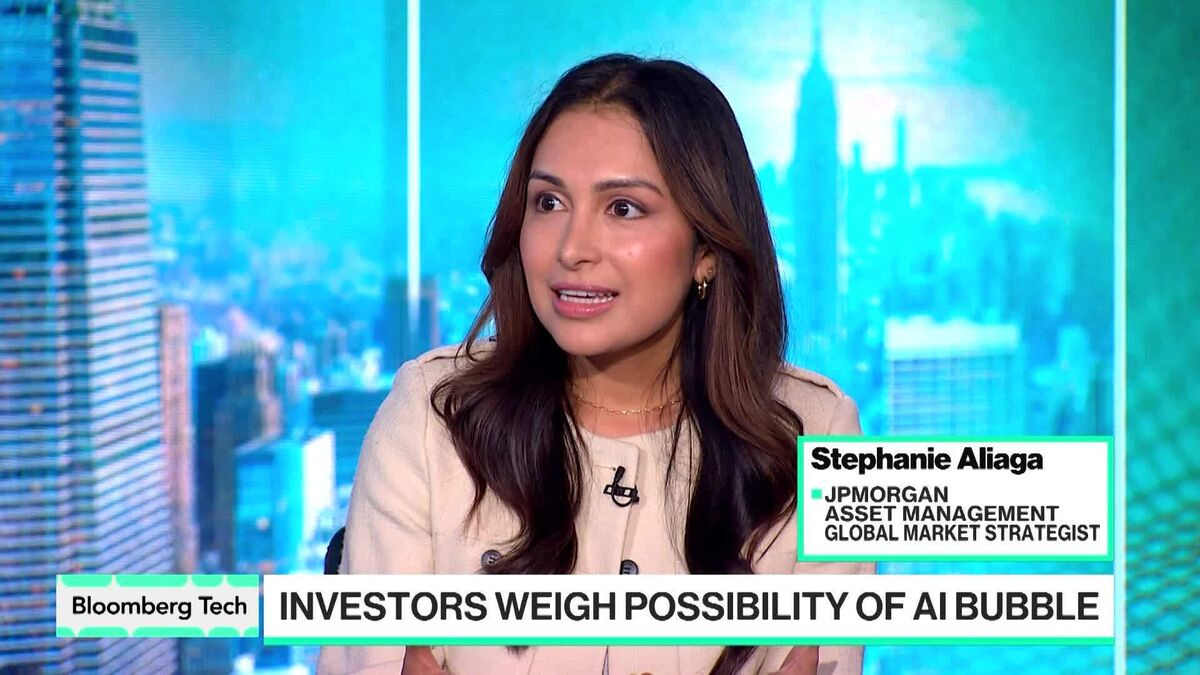

AI Spending Powered by Demand: JPMorgan’s Aliaga

PositiveFinancial Markets

JPMorgan's Global Market Strategist, Stephanie Aliaga, expresses confidence in the current surge of AI spending, attributing it to strong demand. In her discussion with Bloomberg Tech, she emphasizes the importance of discerning between necessary investments and redundant capital commitments, urging investors to be more selective. This perspective is crucial as it highlights the balance between innovation and prudent financial management in the rapidly evolving tech landscape.

— Curated by the World Pulse Now AI Editorial System