Bessent’s Argentina Rescue Pledge Put to Test by Traders Attacking Peso

NegativeFinancial Markets

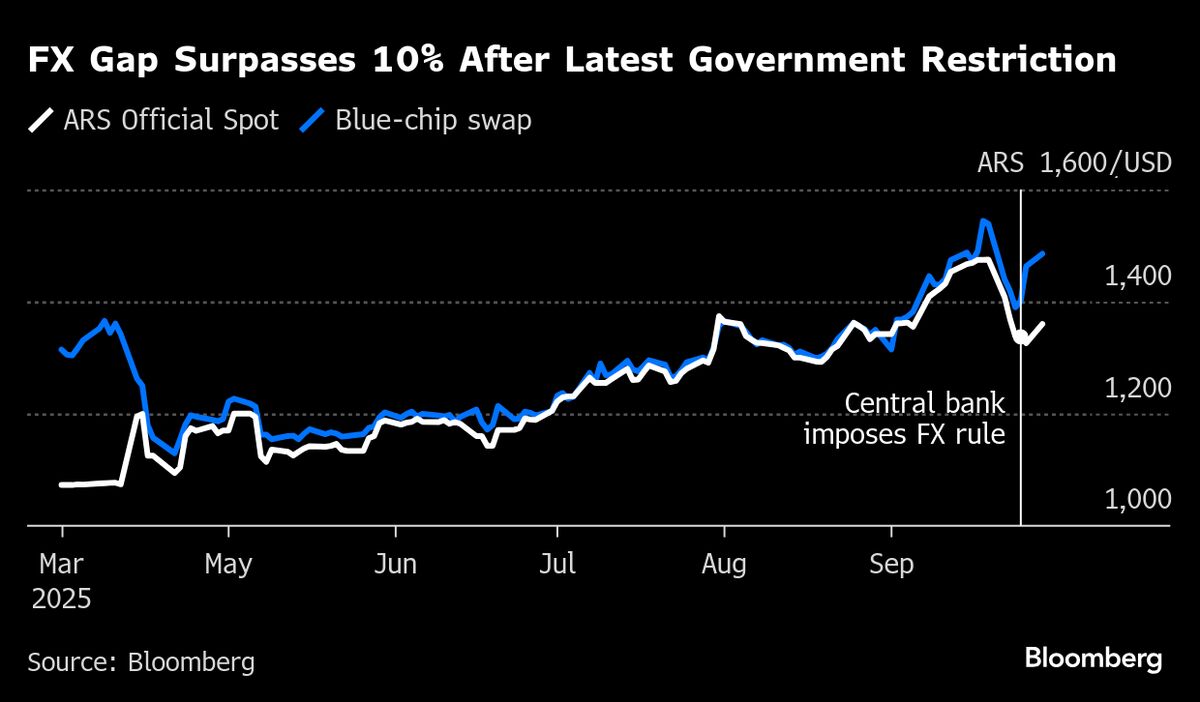

Treasury Secretary Scott Bessent's commitment to stabilize Argentina's economy is facing scrutiny as traders challenge the peso's value. His recent support for President Javier Milei is now under pressure, highlighting the ongoing volatility in the market. This situation is crucial as it reflects the broader economic challenges Argentina is grappling with, and how government pledges can influence investor confidence.

— Curated by the World Pulse Now AI Editorial System