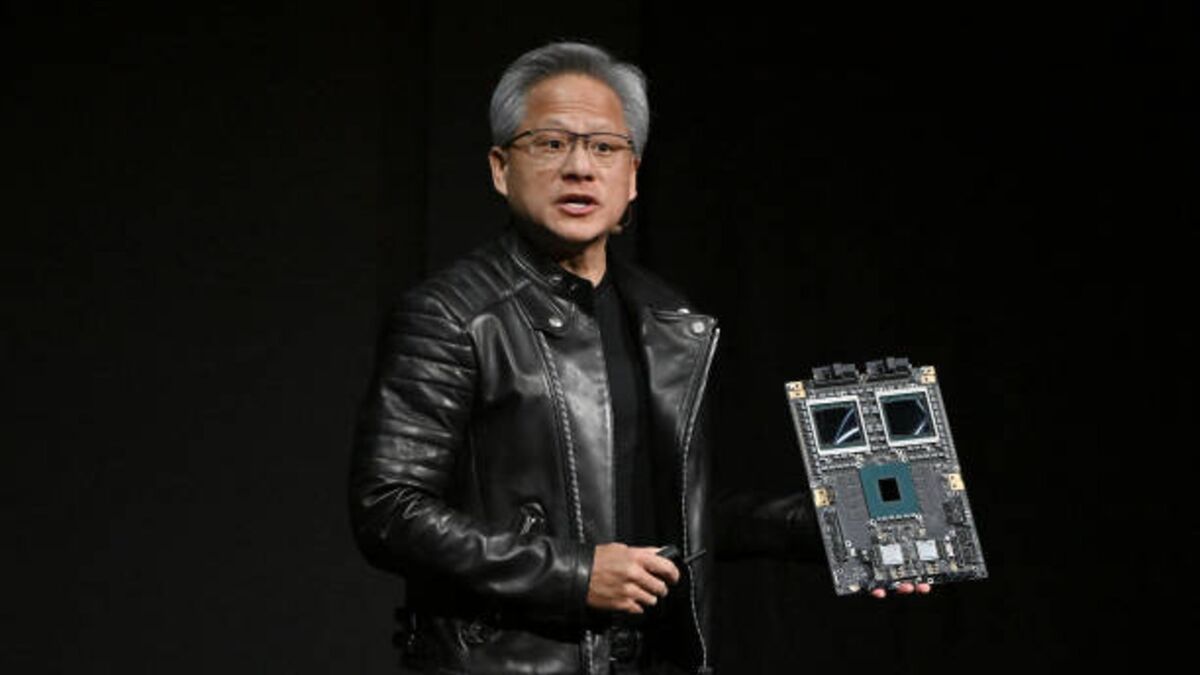

Nvidia-Google AI Chip Battle Escalates

PositiveFinancial Markets

- Meta Platforms is reportedly in discussions to invest billions in Google's AI chips, aiming to compete with Nvidia's dominance in the artificial intelligence sector. This potential deal highlights Meta's strategic shift towards enhancing its AI capabilities and positioning itself as a formidable player in the market.

- The move is significant for Meta as it seeks to bolster its technological infrastructure and innovation in AI, which is crucial for maintaining competitiveness in a rapidly evolving tech landscape. A successful partnership with Google could enhance Meta's product offerings and market share.

- This development occurs amid ongoing concerns about an AI bubble, with Nvidia facing scrutiny despite strong earnings. Analysts have expressed mixed sentiments regarding the sustainability of the AI boom, while Meta's engagement with Google may signal a shift in market dynamics as companies explore alternatives to Nvidia's established lead.

— via World Pulse Now AI Editorial System