Netflix Co-CEO Peters on Sports and Gaming Push

PositiveFinancial Markets

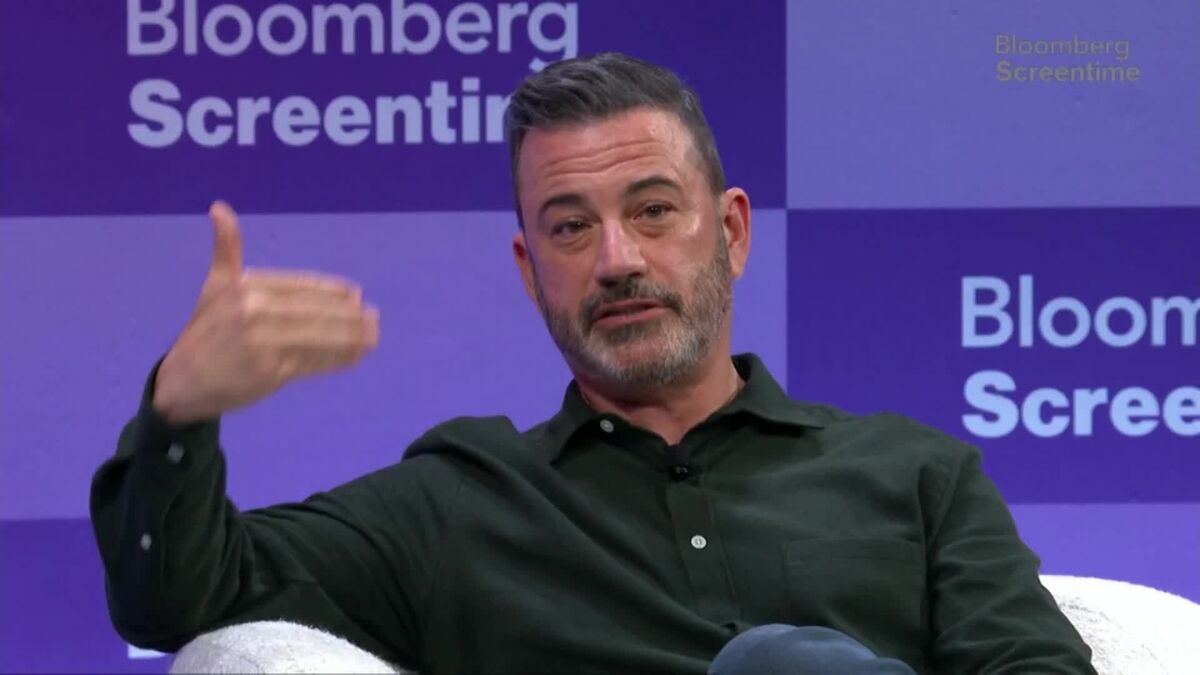

Greg Peters, Co-CEO of Netflix, recently shared insights on the company's strategy to enhance viewer engagement through live sports and a renewed focus on video games during an interview at Bloomberg Screentime in Los Angeles. This move is significant as it reflects Netflix's commitment to diversifying its content offerings and attracting a broader audience, especially in the competitive streaming landscape.

— Curated by the World Pulse Now AI Editorial System