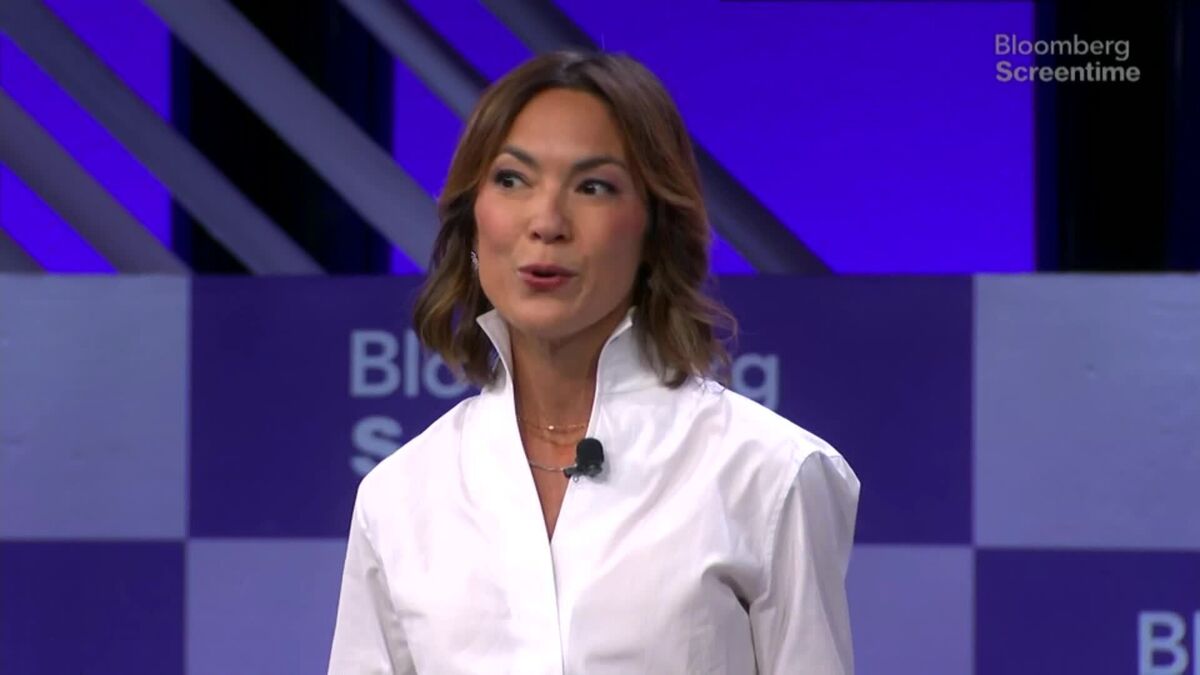

Earnings in Focus in Absence of Data: Herr

NeutralFinancial Markets

Kay Herr, the US Chief Investment Officer for Fixed Income at JPMorgan Asset Management, highlights that with no new government data on the horizon, investors will turn their attention to corporate earnings. This shift is significant as it could influence market strategies and investment decisions, making earnings reports a key focus for analysts and investors alike.

— Curated by the World Pulse Now AI Editorial System