Thermo Fisher prices $2.5 billion notes offering across four maturities

NeutralFinancial Markets

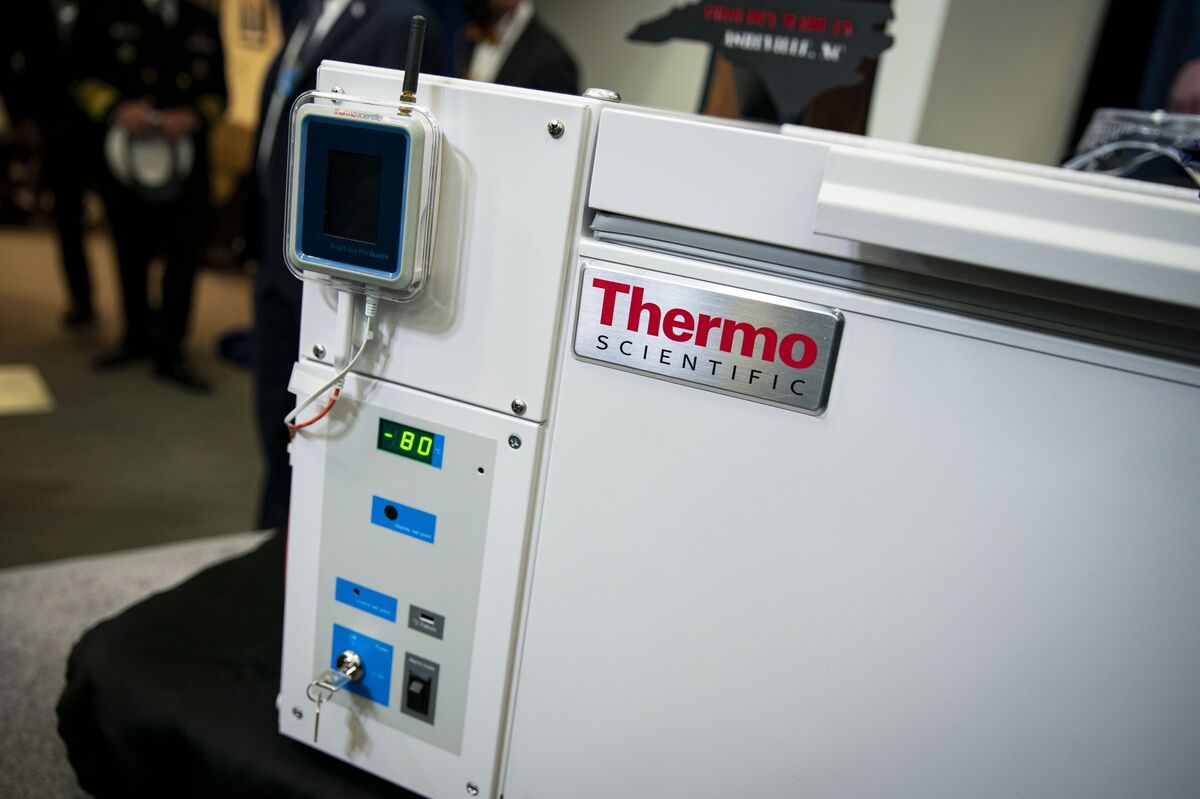

Thermo Fisher Scientific has successfully priced a $2.5 billion notes offering across four different maturities. This move is significant as it allows the company to raise substantial capital, which can be used for various strategic initiatives, including investments in research and development or potential acquisitions. The pricing of these notes reflects the company's strong market position and investor confidence.

— Curated by the World Pulse Now AI Editorial System