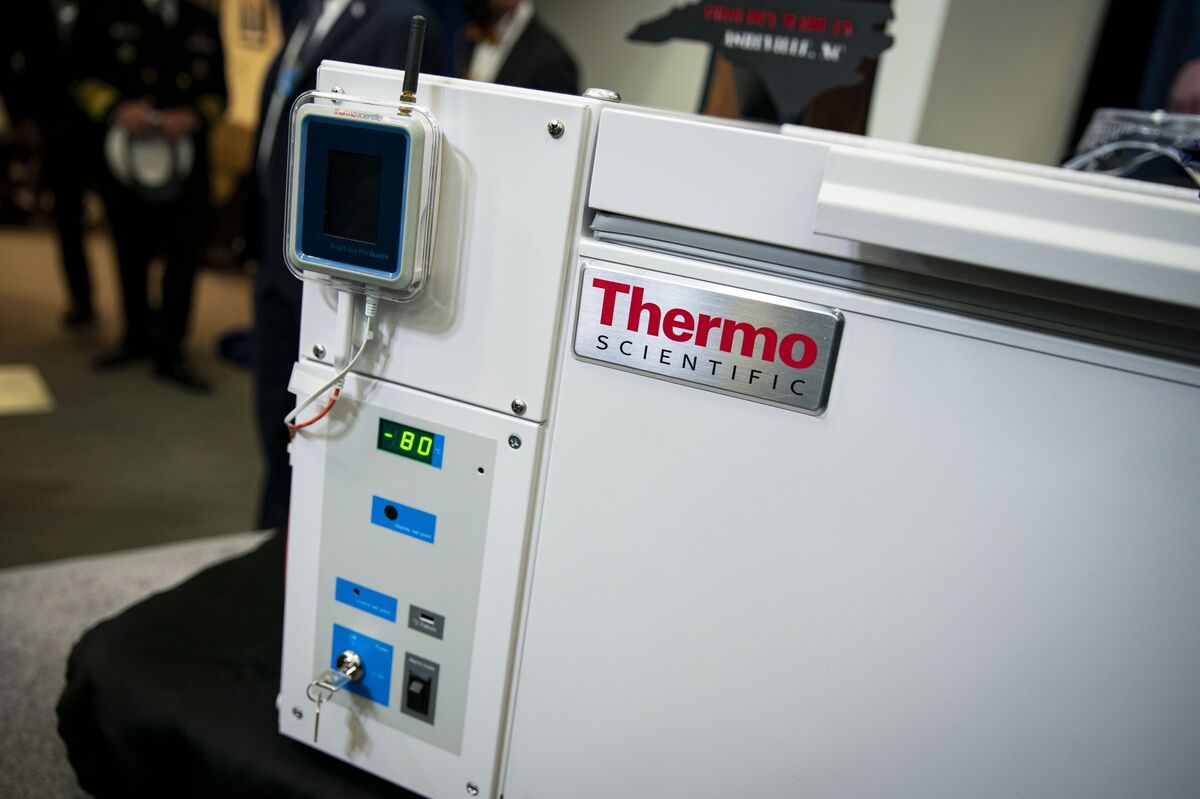

Vaxcyte signs $1 billion manufacturing deal with Thermo Fisher

PositiveFinancial Markets

Vaxcyte has secured a significant $1 billion manufacturing deal with Thermo Fisher, marking a major milestone for the company. This partnership is expected to enhance Vaxcyte's production capabilities, allowing them to scale up their operations and meet growing demand for their innovative vaccines. Such collaborations are crucial in the biotech industry, as they not only provide financial backing but also leverage Thermo Fisher's extensive expertise in manufacturing, ultimately benefiting public health.

— Curated by the World Pulse Now AI Editorial System