Bloomberg Markets 9/25/2025

NeutralFinancial Markets

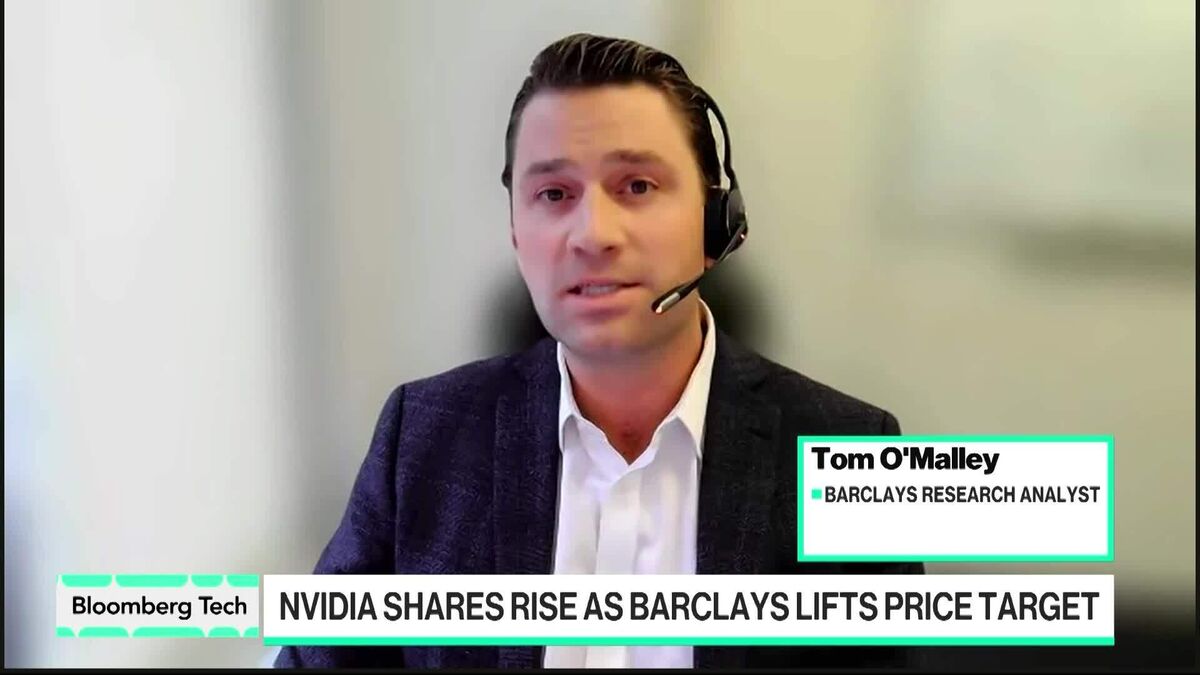

Bloomberg Markets provides an insightful overview of the latest market trends across various global asset classes, featuring discussions with key financial experts. Today's episode includes insights from Blerina Uruci, Chief US Economist at T. Rowe Price, Peter Drury, CIO at Poolside, and Shannon Martin, an insurance expert from Bankrate. This matters as it helps investors and market watchers understand the current economic landscape and make informed decisions.

— Curated by the World Pulse Now AI Editorial System