Euro zone firms optimistic but profits are falling, ECB surveys show

NeutralFinancial Markets

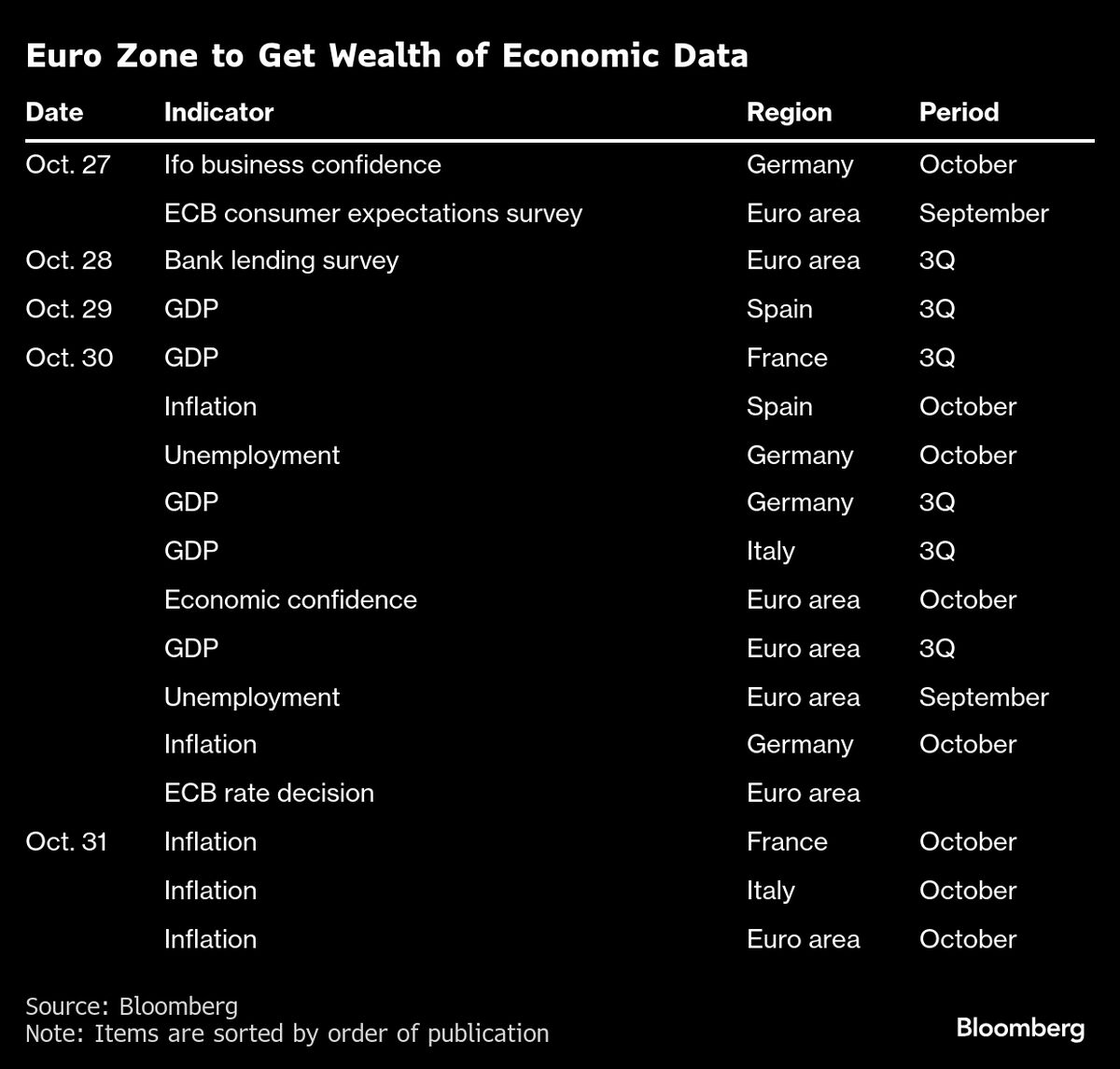

Recent surveys from the European Central Bank reveal that while firms in the euro zone remain optimistic about future growth, they are facing a decline in profits. This situation highlights a complex economic landscape where confidence does not necessarily translate into financial success. Understanding these dynamics is crucial for investors and policymakers as they navigate the challenges of maintaining economic stability.

— Curated by the World Pulse Now AI Editorial System