Euro Zone to Get Hard Data on Tariff Damage as ECB Sets Rates

NeutralFinancial Markets

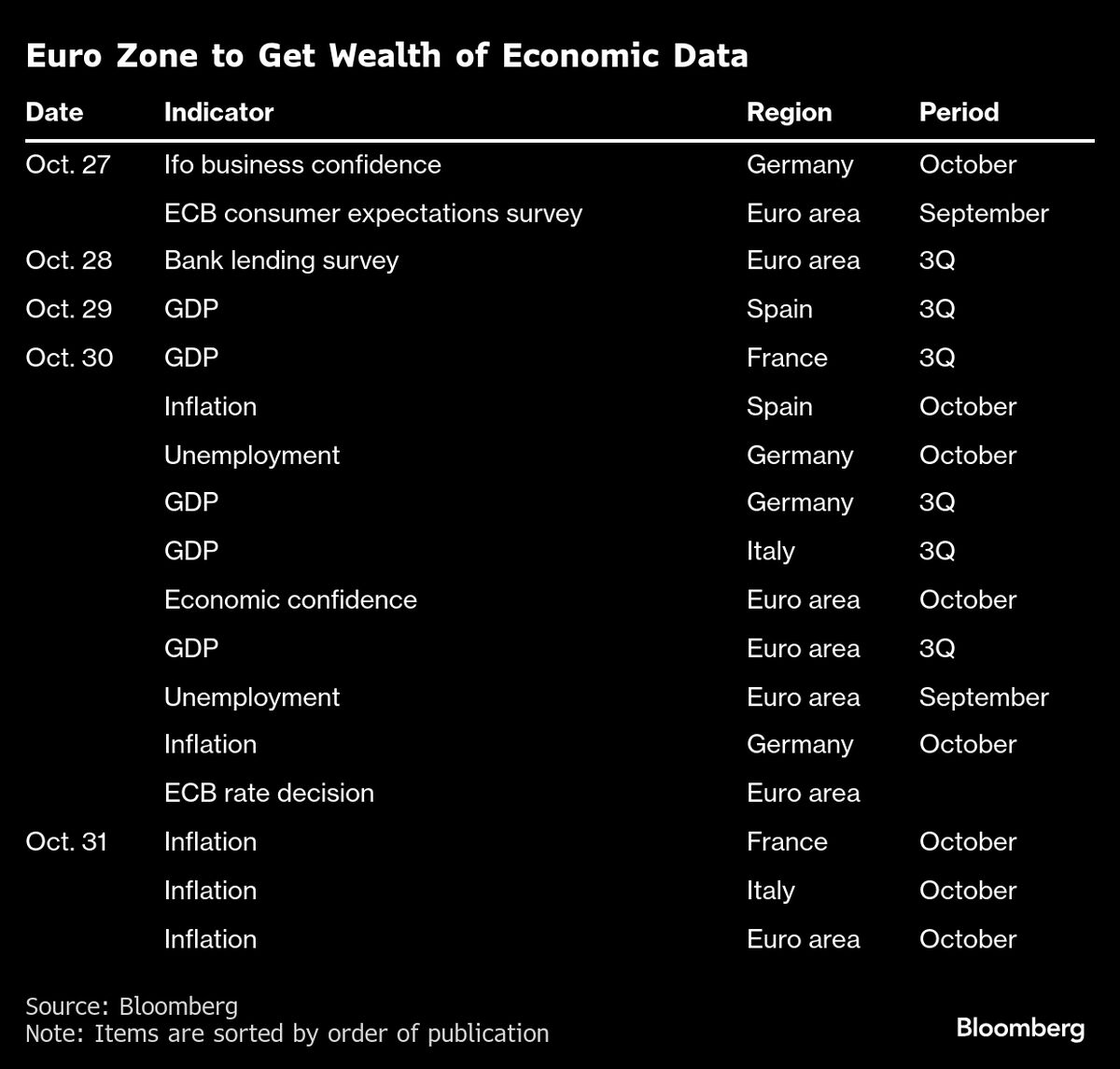

This week, Europe is set to receive crucial economic data that will provide insights into how US tariffs are affecting growth and inflation in the region. As policymakers gather to discuss interest rates, understanding these impacts is vital for making informed decisions that could shape the economic landscape.

— Curated by the World Pulse Now AI Editorial System