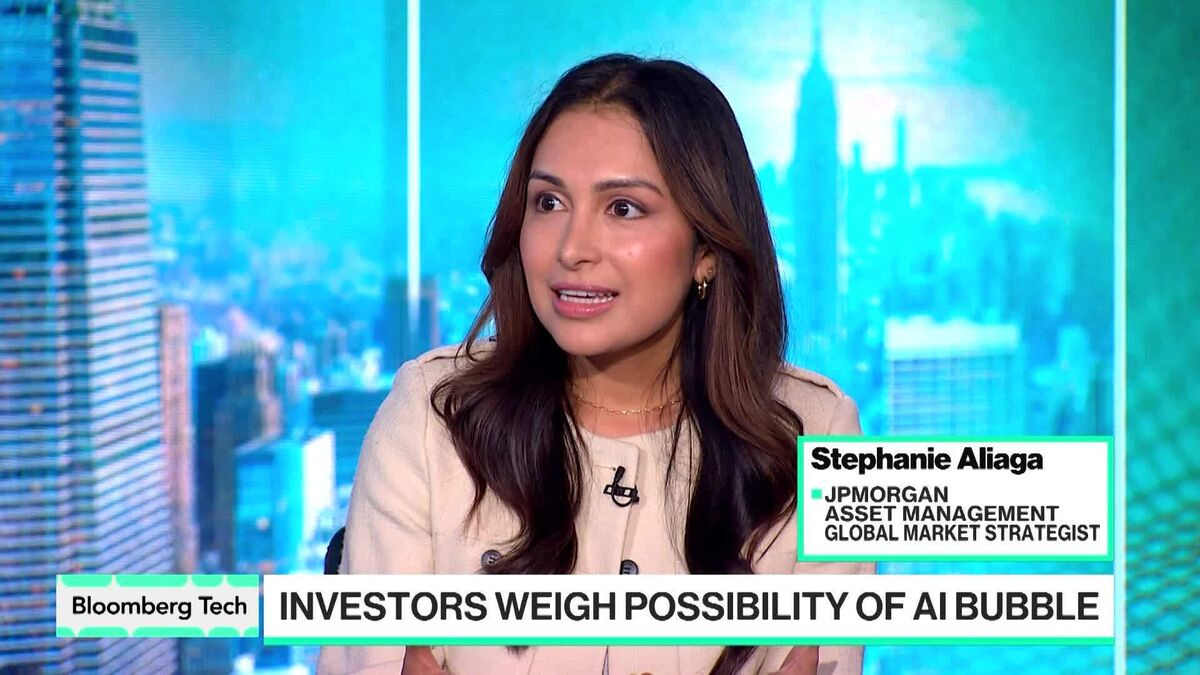

TSX futures inch lower after index falls for third straight session

NegativeFinancial Markets

TSX futures have dipped slightly following a decline in the index for the third consecutive session. This trend raises concerns among investors about the market's stability and potential economic implications. As the index continues to fall, it reflects broader uncertainties in the financial landscape, prompting many to reassess their investment strategies.

— Curated by the World Pulse Now AI Editorial System