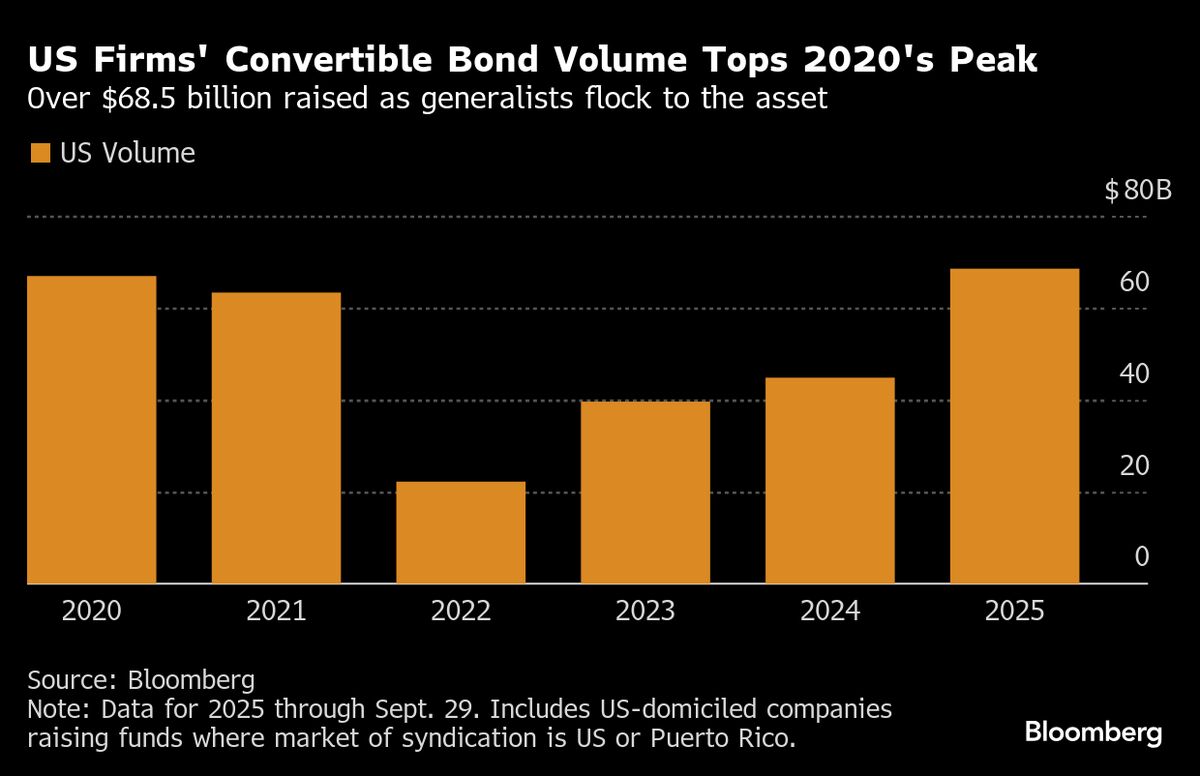

US Equity Raising Tops $255 Billion as Recovery Hits Third Year

PositiveFinancial Markets

The US equity capital markets are experiencing a significant resurgence, with over $255 billion raised as the recovery enters its third year. This positive trend is largely driven by a remarkable third quarter for IPOs and an increase in convertible bond activity, signaling renewed confidence among investors and investment bankers. This momentum not only reflects a recovery from the pandemic slump but also indicates a robust market environment that could lead to further growth and opportunities in the financial sector.

— Curated by the World Pulse Now AI Editorial System