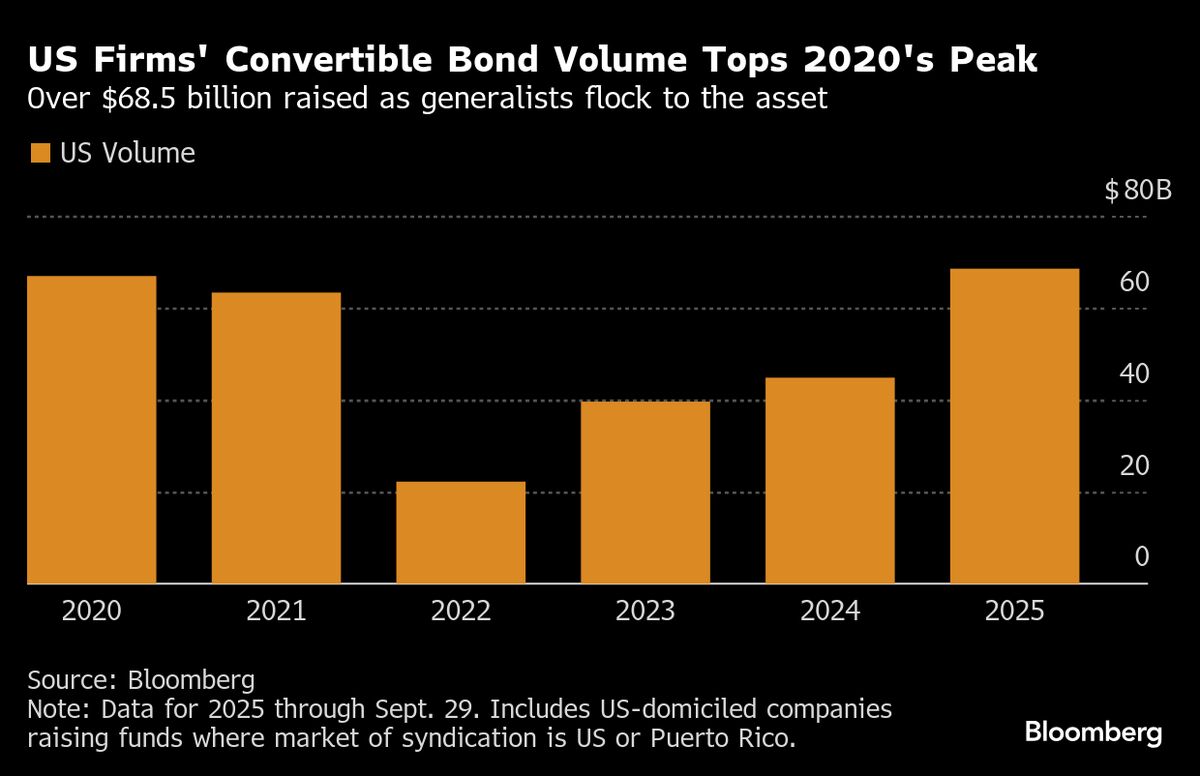

Eye-Popping Power Prices Show AI’s Cost to Consumers

NegativeFinancial Markets

Wholesale electricity prices have skyrocketed by up to 267% in areas close to US data hubs over the past five years, raising concerns about the financial burden on consumers. This surge highlights the hidden costs associated with the growing reliance on artificial intelligence, as increased energy demands from data centers contribute to higher electricity bills. Understanding these trends is crucial for consumers and policymakers alike, as they navigate the balance between technological advancement and economic impact.

— Curated by the World Pulse Now AI Editorial System