Tech giants are spending big on AI in rush to dominate the boom

PositiveFinancial Markets

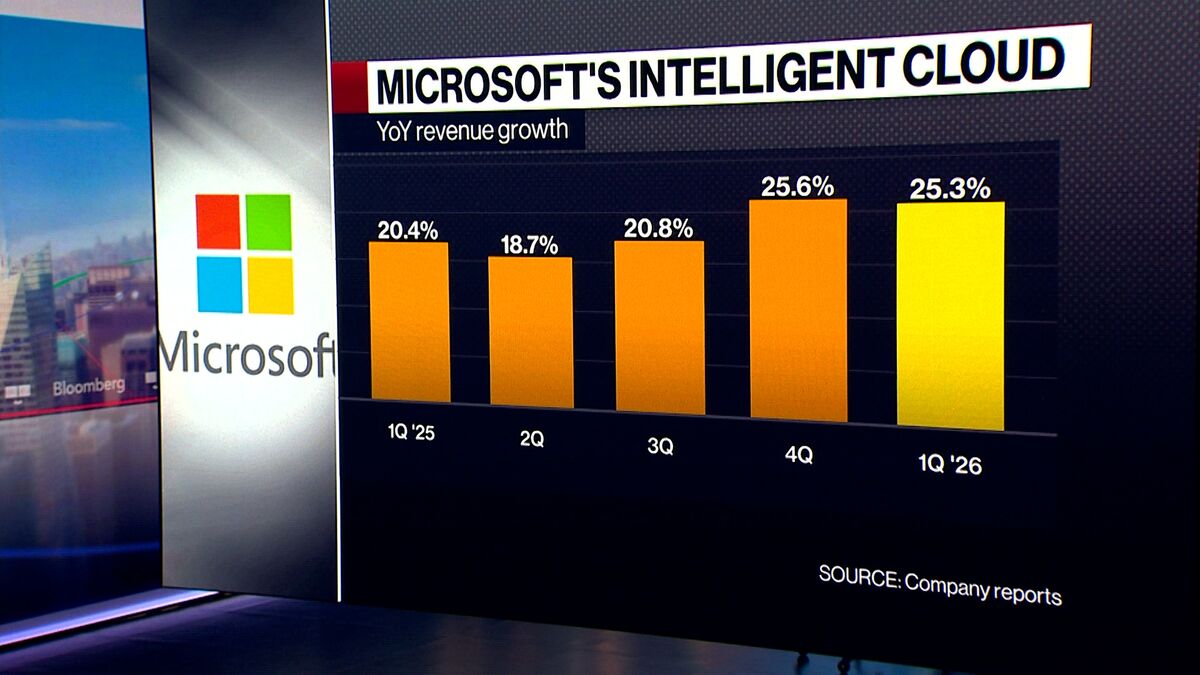

Tech giants like Meta, Alphabet, and Microsoft are significantly increasing their investments in artificial intelligence, as highlighted by their recent earnings reports. This surge in spending reflects their eagerness to capitalize on the booming AI market, which is expected to transform various industries and create new opportunities. As these companies race to innovate and lead in AI technology, it could reshape the competitive landscape and drive advancements that benefit consumers and businesses alike.

— Curated by the World Pulse Now AI Editorial System