Former Azure Lead on Microsoft Earnings

PositiveFinancial Markets

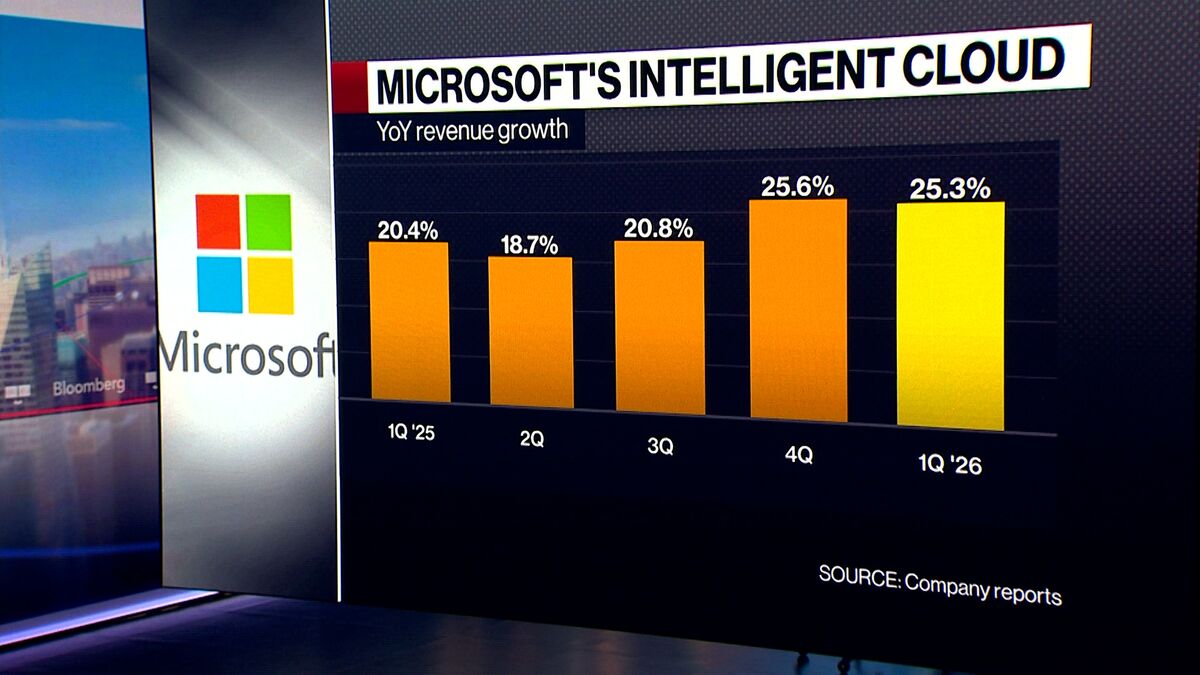

Sheila Gulati, the founder of Tola Capital, recently shared her insights on Microsoft’s earnings, emphasizing that we are not in an AI bubble but rather experiencing a significant societal shift. She compared current concerns about AI to those during the rise of cloud computing, suggesting that this transformation is just as impactful. This perspective is important as it highlights the potential of AI to reshape industries and everyday life, encouraging investors and businesses to embrace the change rather than fear it.

— Curated by the World Pulse Now AI Editorial System