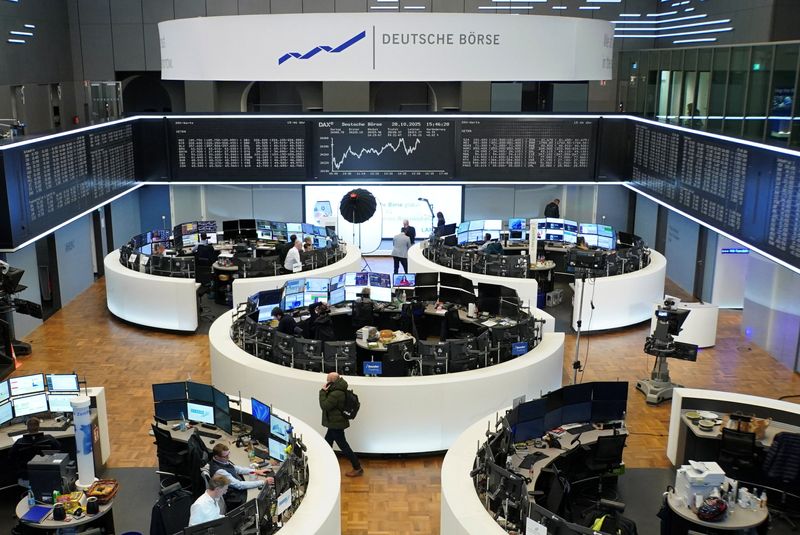

European stocks steady ahead of Fed rate decision; UBS reports profits surge

PositiveFinancial Markets

European stocks are holding steady as investors await the Federal Reserve's decision on interest rates. This comes on the heels of UBS reporting a significant surge in profits, which reflects strong performance in the banking sector. The stability in the stock market and positive earnings from major companies like UBS indicate a resilient economic outlook, making it an important moment for investors and analysts alike.

— Curated by the World Pulse Now AI Editorial System