Trump says he will cut fentanyl tariff on Chinese goods and expects ‘great deal’ with Xi – business live

PositiveFinancial Markets

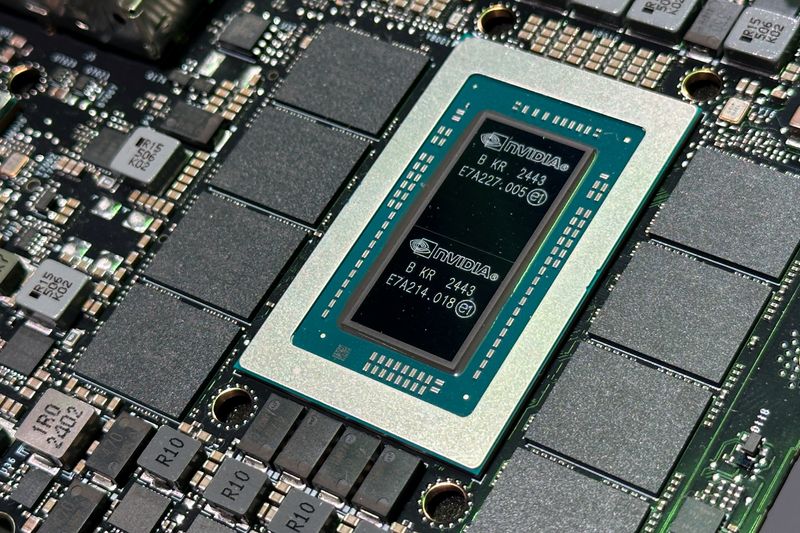

In a positive turn for international trade, Donald Trump announced plans to cut tariffs on fentanyl-related goods from China, expressing optimism about a potential 'great deal' with Chinese leader Xi Jinping. This news has sparked a rally in Asian stock markets, reflecting investor confidence. Notably, shares of Nvidia surged after Trump praised the company's new Blackwell AI processors, which were recently showcased by CEO Jensen Huang. This development is significant as it highlights the ongoing dialogue between the US and China, potentially easing trade tensions and benefiting the tech sector.

— Curated by the World Pulse Now AI Editorial System