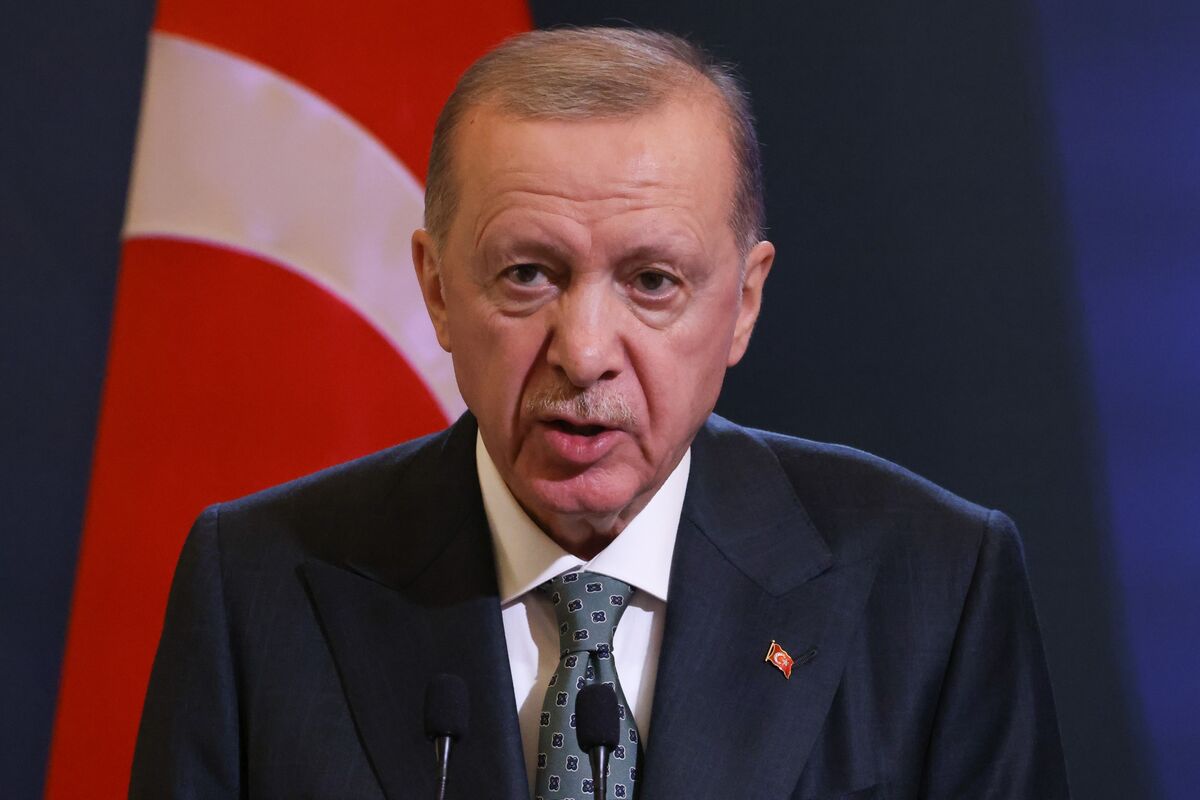

Why Crackdown on Turkish Opposition Is Rattling Markets

NegativeFinancial Markets

The recent crackdown on political opposition in Turkey is causing significant concern among investors, leading to a decline in Turkish stocks and bonds. This situation highlights the importance of political stability for emerging markets, as President Recep Tayyip Erdogan's extended rule raises fears about the future of democracy and economic health in the country. Investors are closely watching these developments, as they could have broader implications for market confidence and investment strategies.

— Curated by the World Pulse Now AI Editorial System