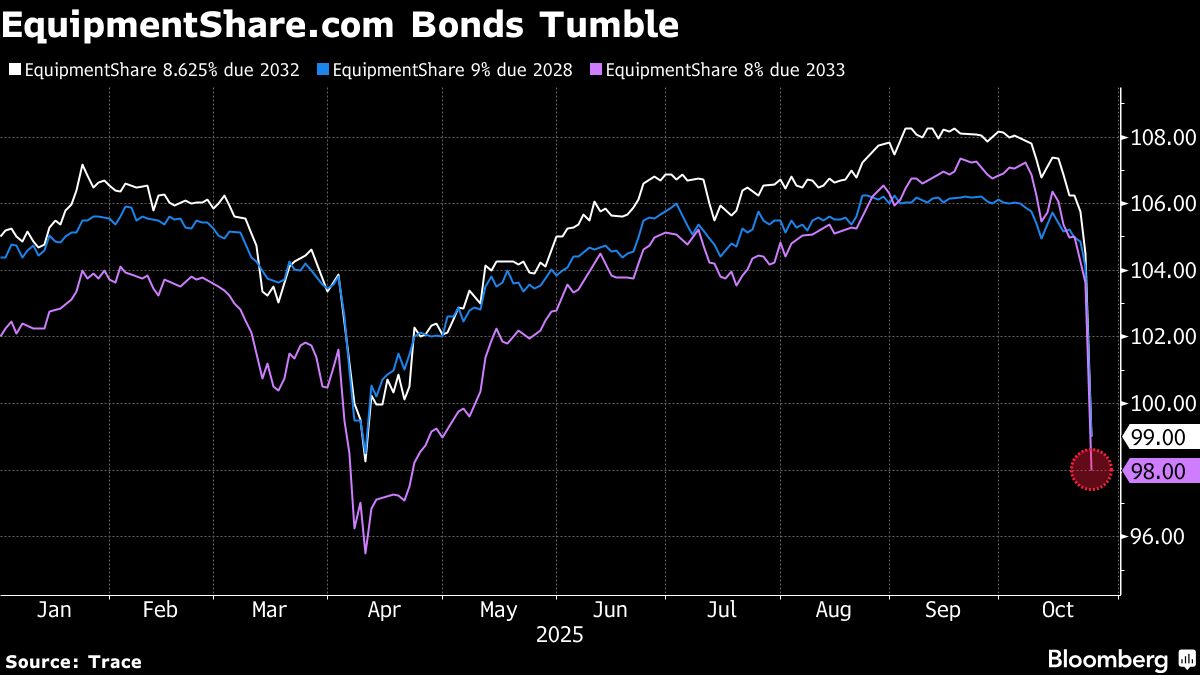

Bonds Should Be Boring. But They’ve Been on a Roller Coaster.

NegativeFinancial Markets

Bonds, traditionally seen as a safe investment, have recently experienced significant volatility, leaving risk-averse investors feeling uneasy. While there have been some reassuring returns, underlying troubles suggest that the bond market is far from stable. This matters because it challenges the perception of bonds as a reliable haven, prompting investors to reconsider their strategies in an unpredictable financial landscape.

— Curated by the World Pulse Now AI Editorial System