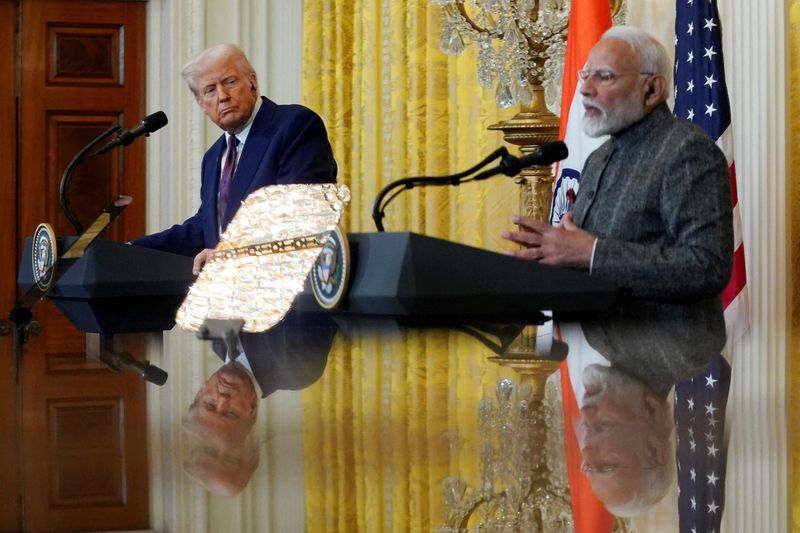

Oil Rises as Trump Says India Will Stop Buying Russian Supply

PositiveFinancial Markets

Oil prices have surged after President Donald Trump announced that Indian Prime Minister Narendra Modi plans to stop buying Russian oil. This decision could significantly impact global oil supply, potentially leading to higher prices and a tighter market. It's a noteworthy development as it reflects shifting alliances and the ongoing geopolitical tensions surrounding energy resources.

— Curated by the World Pulse Now AI Editorial System