If Argentina's Milei Loses Vote, 'We're Out,' Says Trump

NeutralFinancial Markets

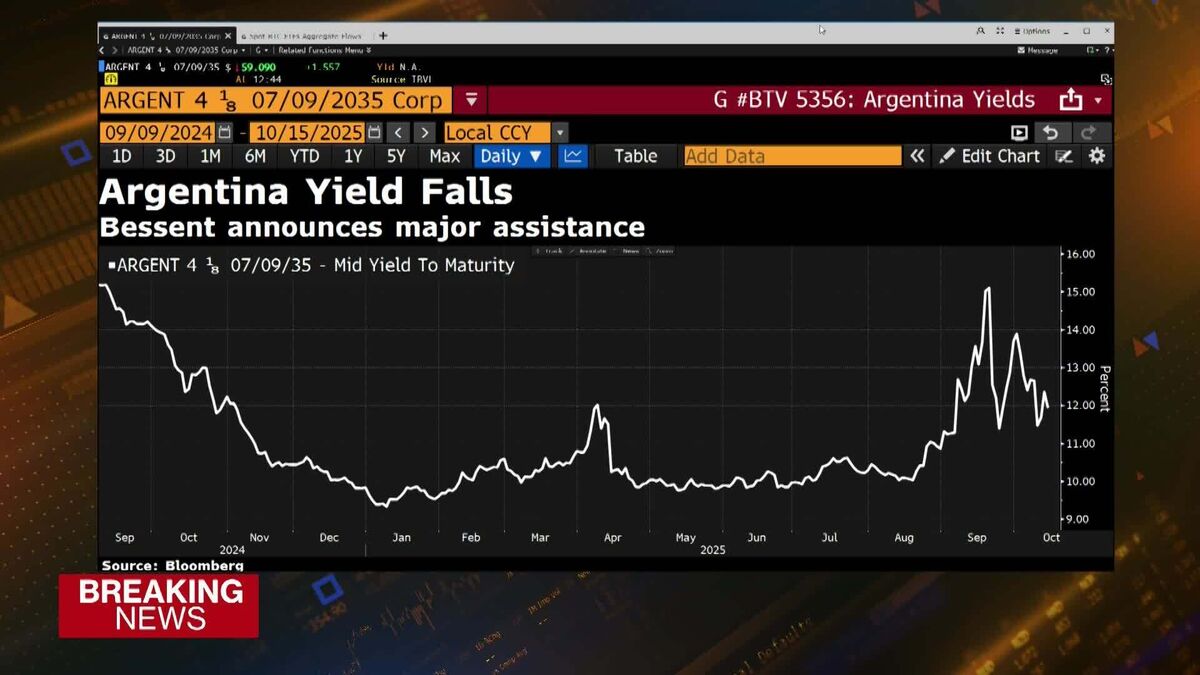

In a recent statement, former President Donald Trump indicated that the United States' planned $20 billion support for Argentina may depend on the outcome of the upcoming midterm elections, specifically the success of libertarian leader Javier Milei. Trump emphasized that if Milei wins, the U.S. will continue its support, but if he loses, they might withdraw. This situation highlights the interconnectedness of U.S. foreign aid and political outcomes in other countries, making it a significant point of discussion for both nations.

— Curated by the World Pulse Now AI Editorial System