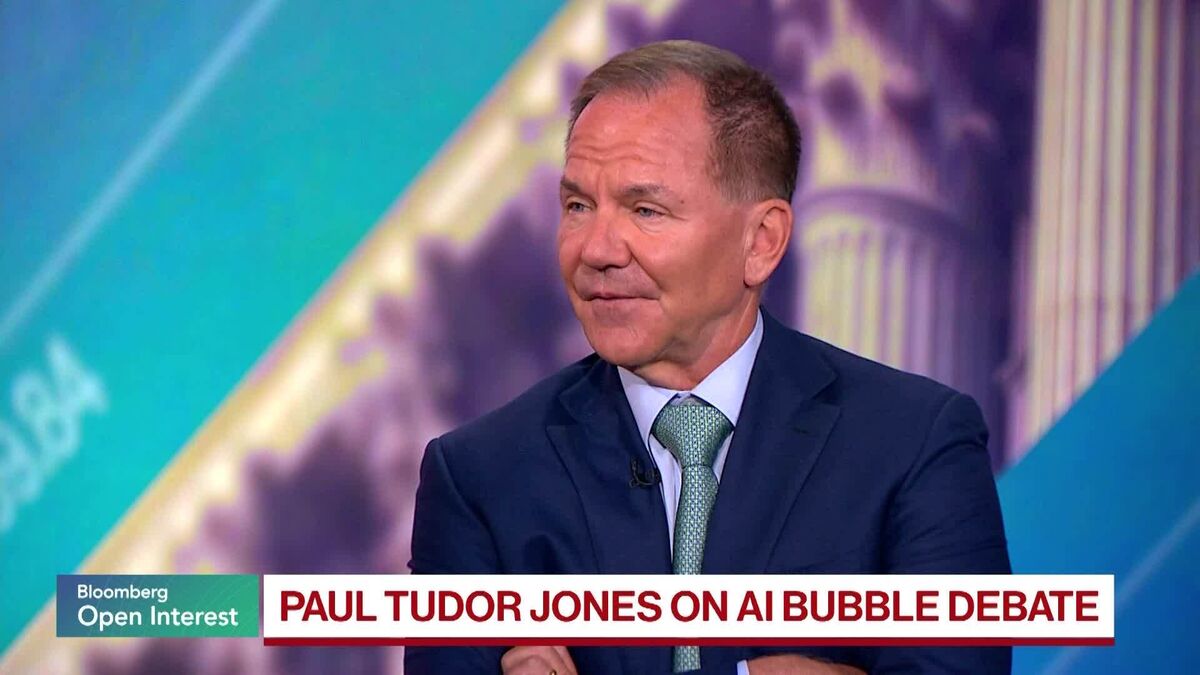

Billionaire Paul Tudor Jones Sees Nasdaq Higher by Year End

PositiveFinancial Markets

Billionaire investor Paul Tudor Jones is optimistic about the Nasdaq Composite Index, predicting it will rise by the end of the year. This positive outlook comes as traders are hopeful for lower interest rates, which could stimulate market growth. Jones's insights are significant as they reflect broader market sentiments and could influence investor behavior.

— Curated by the World Pulse Now AI Editorial System