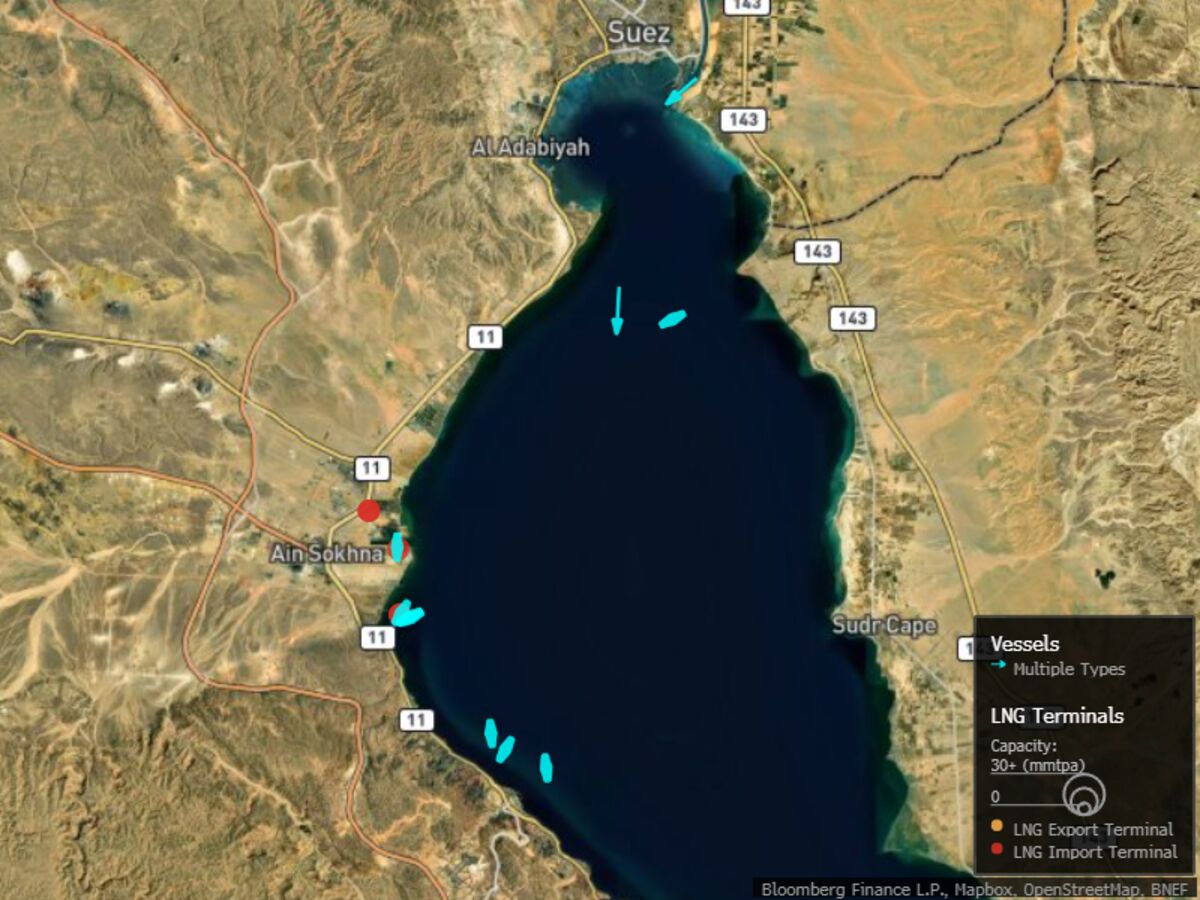

LNG Ships Pile Up Near Egypt Terminals as Demand Craters

NegativeFinancial Markets

Three liquefied natural gas vessels are currently waiting outside Egypt's import terminals due to scheduling issues and a rapid decline in seasonal demand for fuel. This situation highlights the challenges facing the energy sector in North Africa, as reduced demand can lead to significant economic implications for the region.

— Curated by the World Pulse Now AI Editorial System