JPMorgan Trading Desk Says Buy the Dip in Stocks

PositiveFinancial Markets

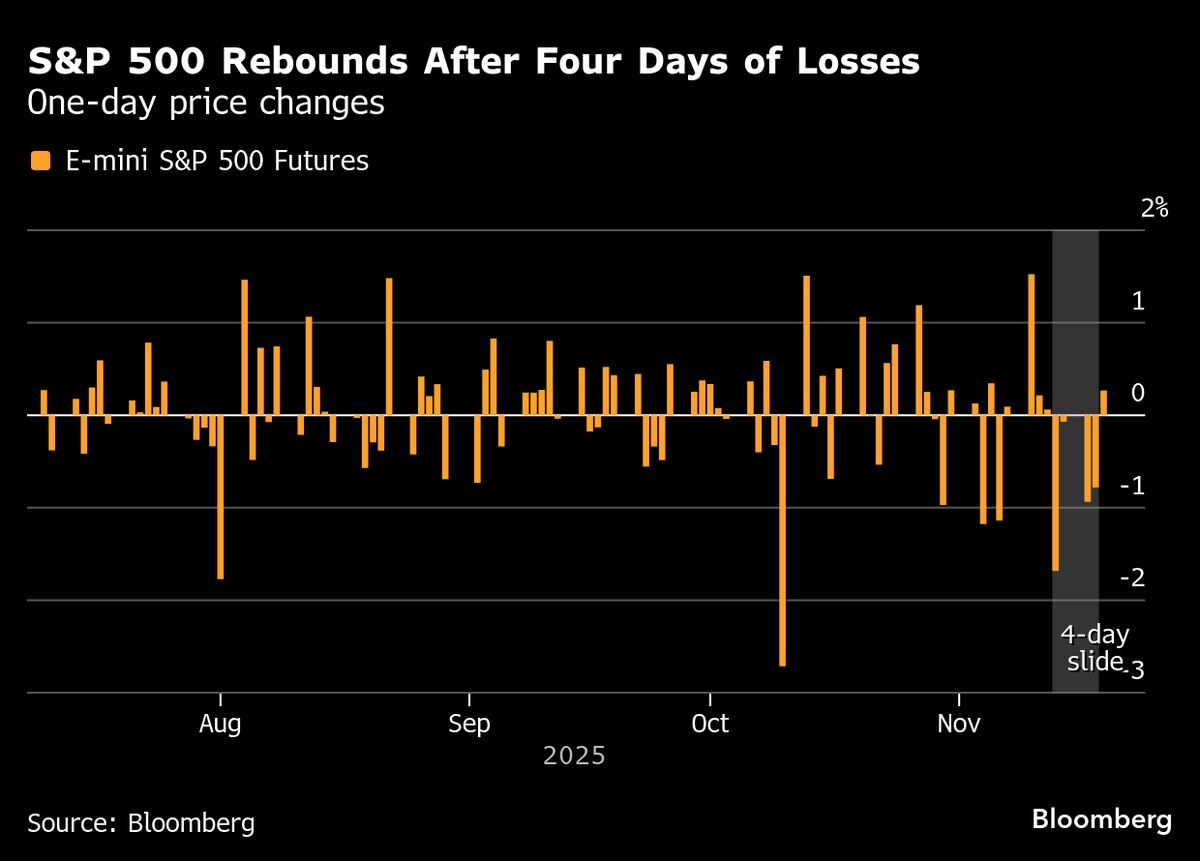

- JPMorgan Chase & Co. has identified a buying opportunity in US stocks following the longest decline since August, suggesting that investors should consider purchasing during this dip.

- This recommendation reflects JPMorgan's confidence in the market's potential recovery, positioning the bank as a key player in guiding investor sentiment amidst volatility.

- The broader context includes concerns over economic stability and potential corrections in sectors like AI, which could influence market dynamics and investor strategies.

— via World Pulse Now AI Editorial System