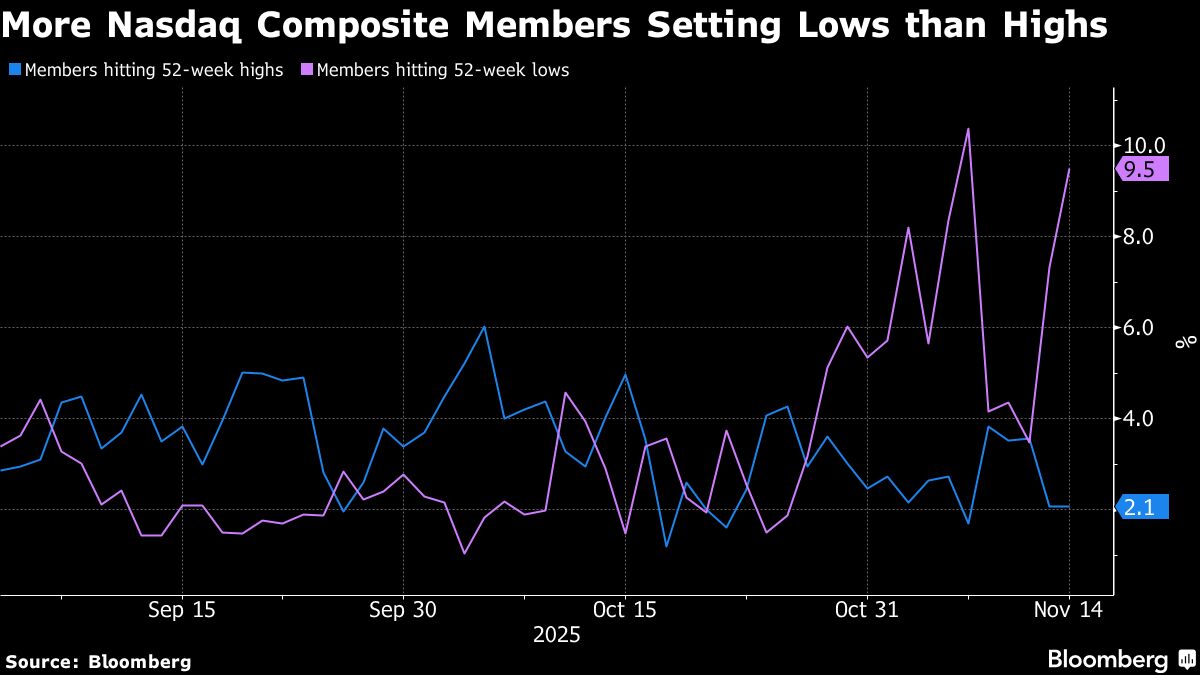

Stocks ‘Running Out of Time’ For a Year-End Rally Without Tech

NegativeFinancial Markets

- US stocks are struggling on Wall Street, with recent trading indicating a potential inability to achieve a year

- This development is significant as it raises questions about investor confidence and market stability. If the trend continues, it could lead to a more cautious approach from investors, impacting overall market dynamics and potentially stalling economic recovery efforts.

— via World Pulse Now AI Editorial System