Lodging Firm Sonder Seeks Creditor Deal to Avoid Bankruptcy

NegativeFinancial Markets

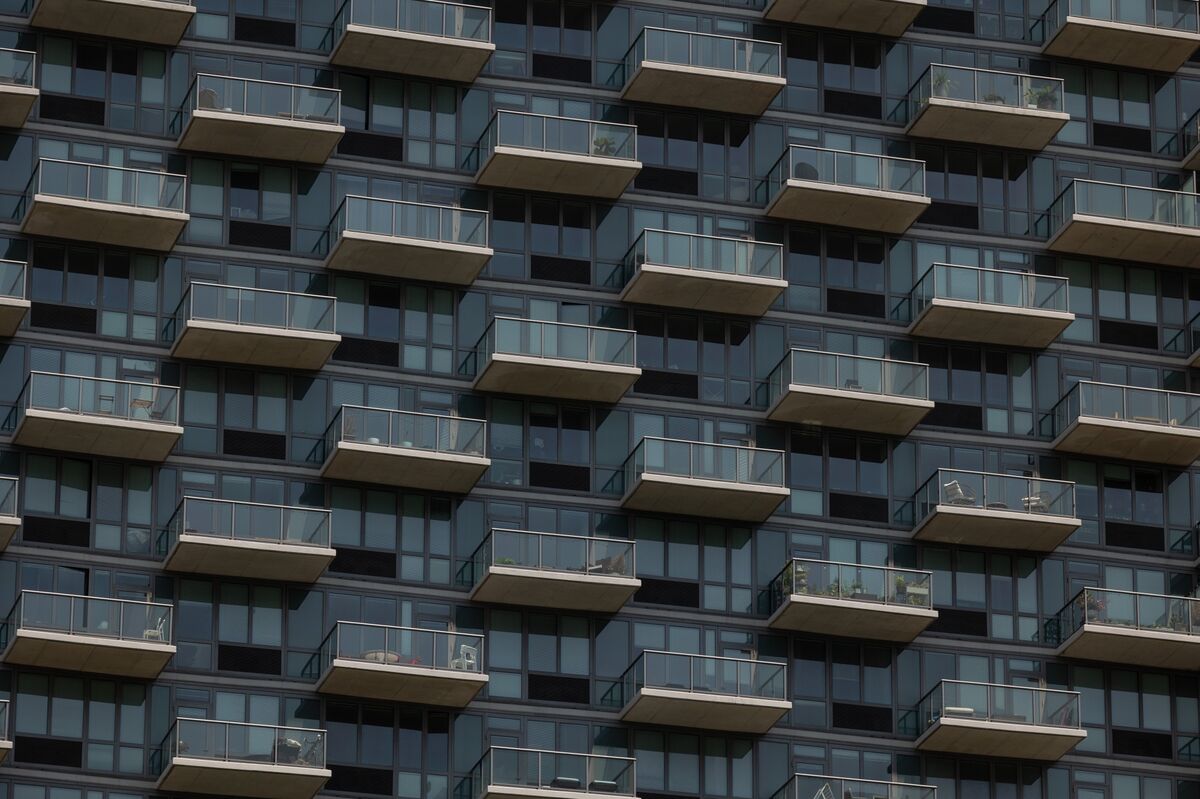

Sonder Holdings Inc., known for its unique boutique apartment rentals, is in a precarious situation as it seeks an out-of-court agreement with creditors to stave off bankruptcy. This move highlights the challenges faced by rental companies in a competitive market and raises concerns about the future of such businesses. If Sonder fails to secure a deal, it could lead to significant repercussions for its operations and employees, making this a critical moment for the company.

— Curated by the World Pulse Now AI Editorial System