Hong Kong's unemployment rate remains at 3.7% in June-August

NeutralFinancial Markets

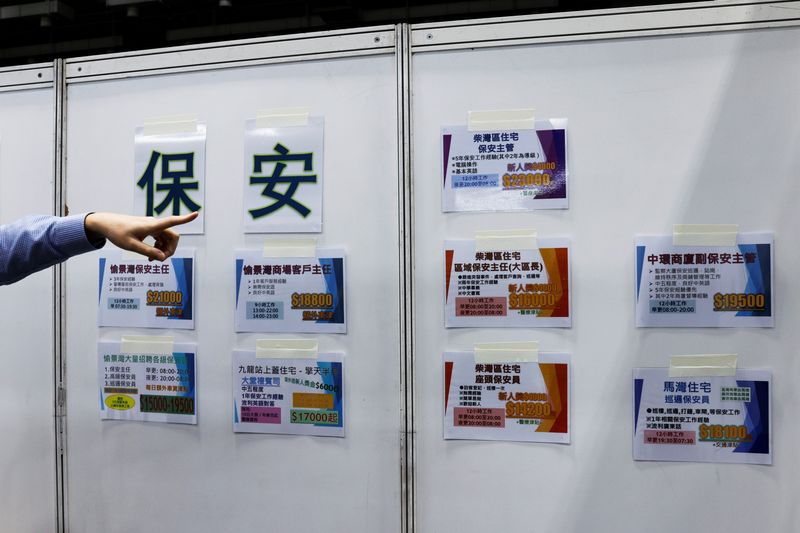

Hong Kong's unemployment rate held steady at 3.7% for the period of June to August, indicating stability in the job market despite ongoing economic challenges.

Editor’s Note: This stability in the unemployment rate is significant as it reflects the resilience of Hong Kong's economy amidst various global uncertainties. Understanding these trends can help policymakers and businesses make informed decisions.

— Curated by the World Pulse Now AI Editorial System