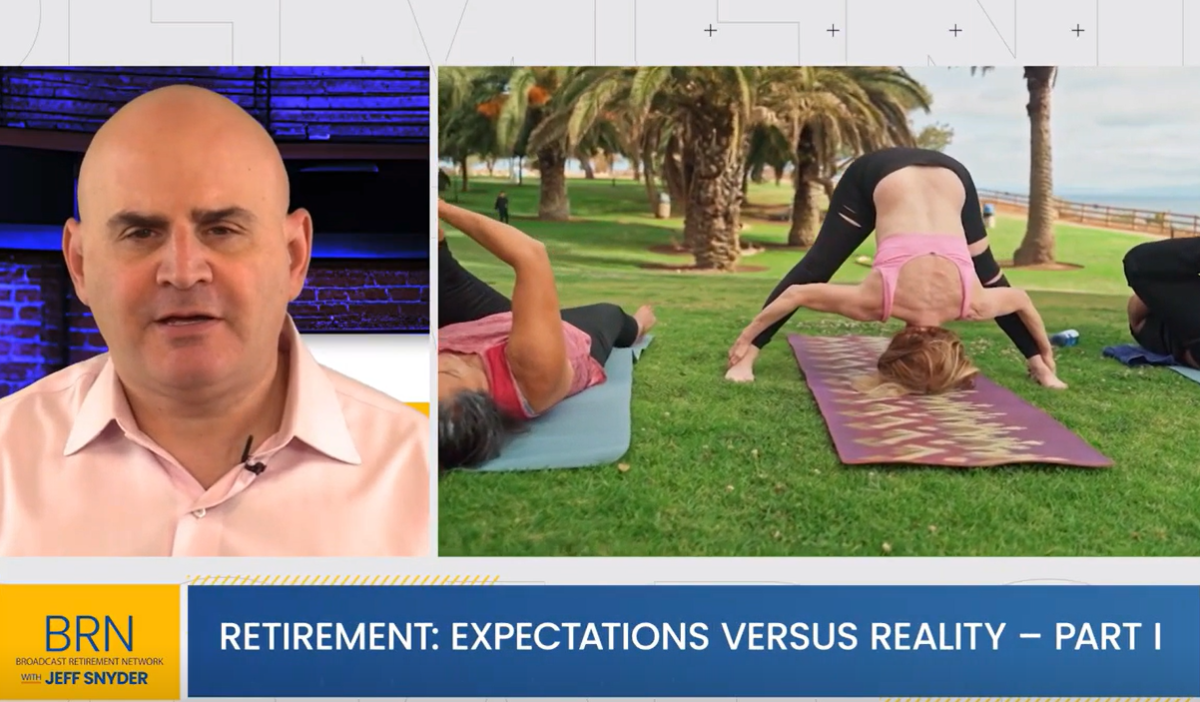

Retirement: Expectations vs. Reality - Part II

NeutralFinancial Markets

In the latest discussion on retirement, Jeffrey H. Snyder from the Broadcast Retirement Network highlights a significant gap between expectations and reality regarding work during retirement. While 75% of people anticipate continuing to work, only about 30% actually do. This conversation with Zhikun Liu from MissionSquare Research Institute sheds light on the factors influencing these statistics, making it crucial for future retirees to reassess their plans and expectations.

— Curated by the World Pulse Now AI Editorial System