This or That: Stocks higher or lower by year-end?

NeutralFinancial Markets

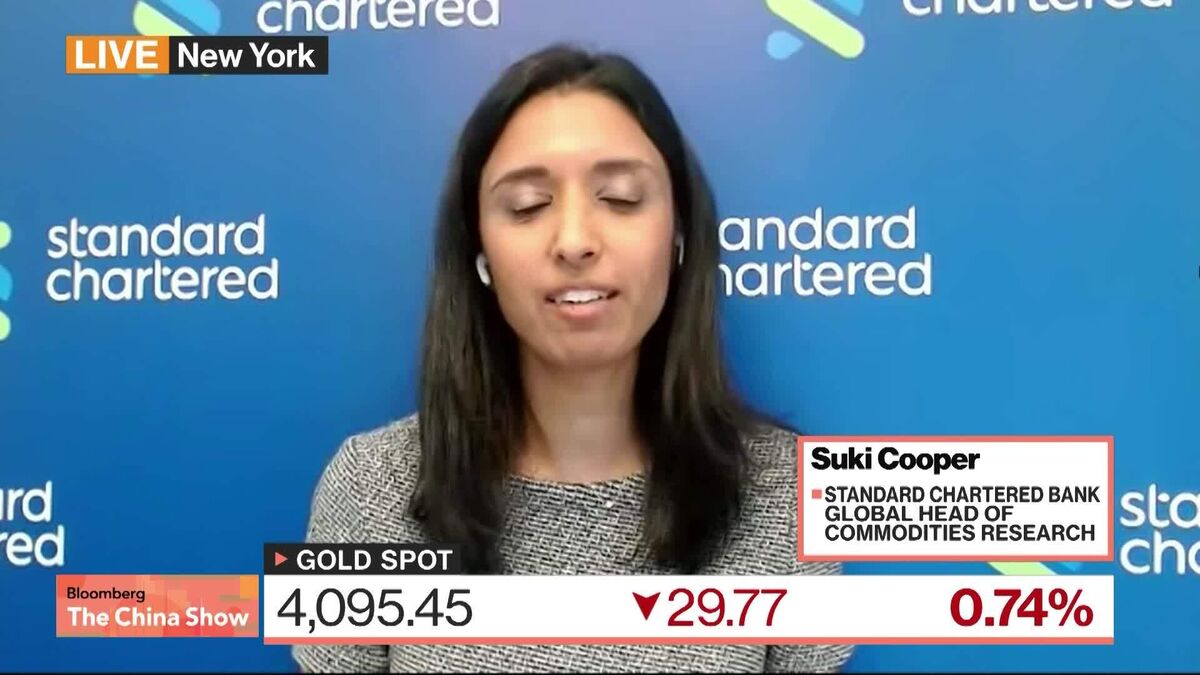

In a recent discussion, Chief Investment Officer Kevin Mahn tackled the pressing question of whether stocks will rise or fall by year-end. He engaged in a rapid-fire game of 'This or That,' weighing the merits of buying the dip against waiting for a potential pullback. This conversation is significant as it reflects the current market sentiment and helps investors navigate their strategies in a fluctuating economic landscape.

— Curated by the World Pulse Now AI Editorial System