‘Home, home’: Israel erupts as hostages are freed

PositiveFinancial Markets

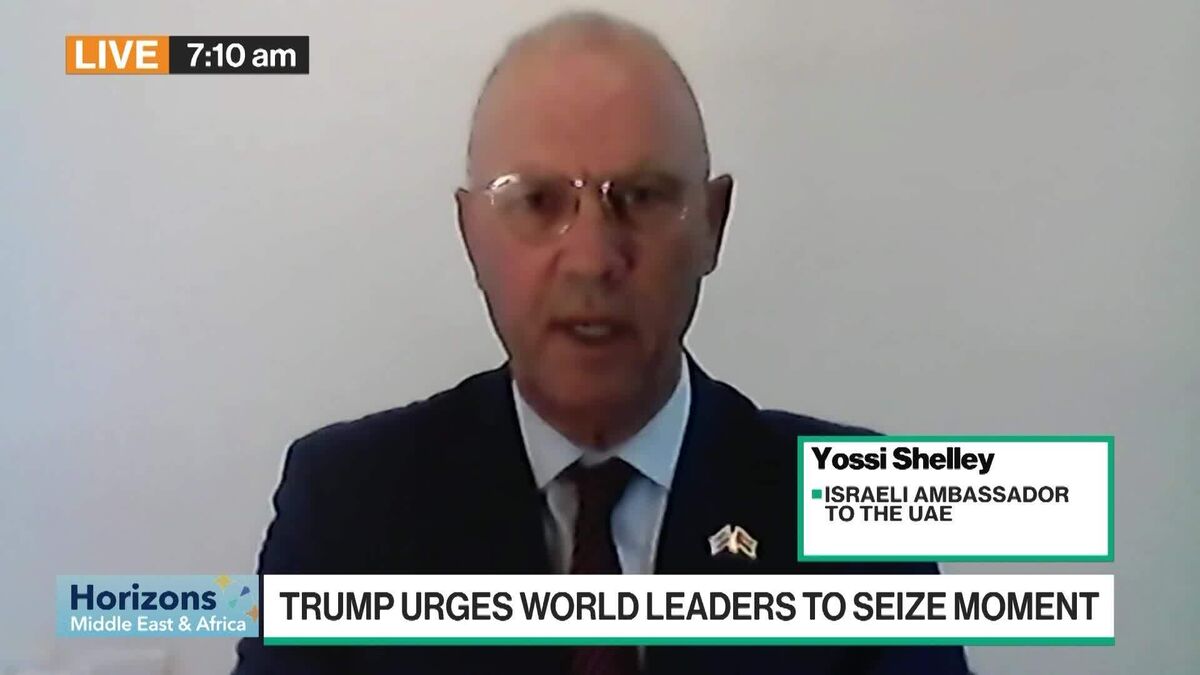

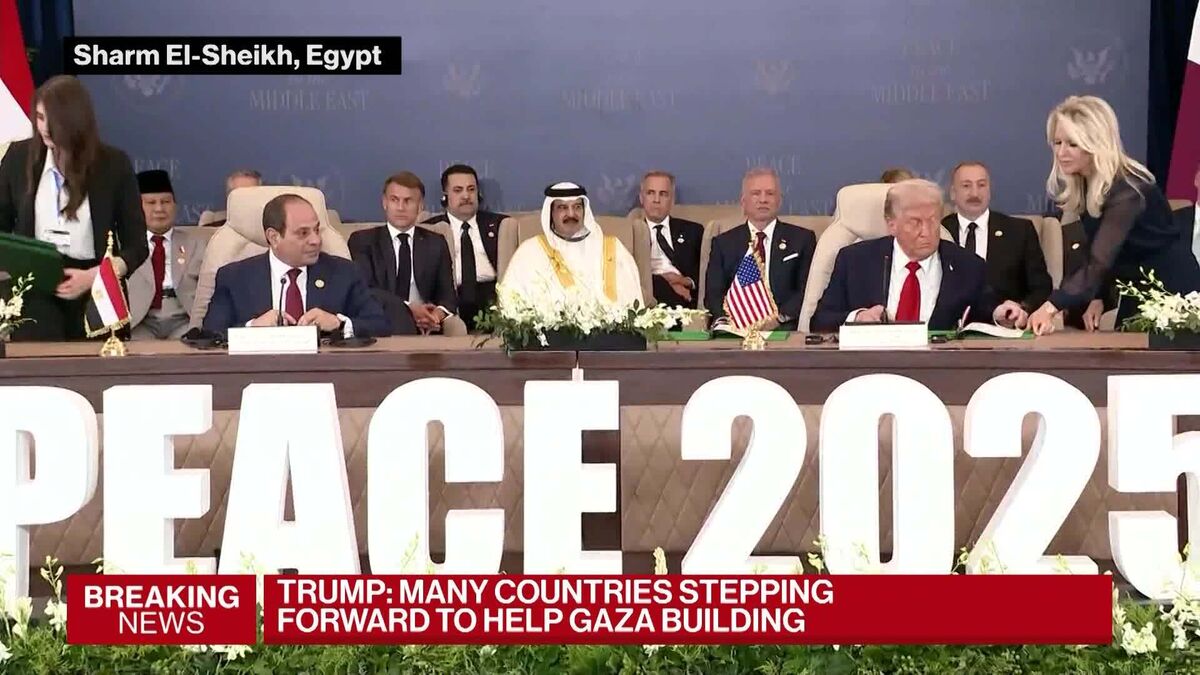

Israel is celebrating a momentous occasion as hostages are finally freed after two years of anguish. The emotional release has brought tears of joy to many, marking a significant turning point for the nation. This event not only highlights the resilience of the Israeli people but also underscores the importance of hope and unity in times of hardship.

— Curated by the World Pulse Now AI Editorial System