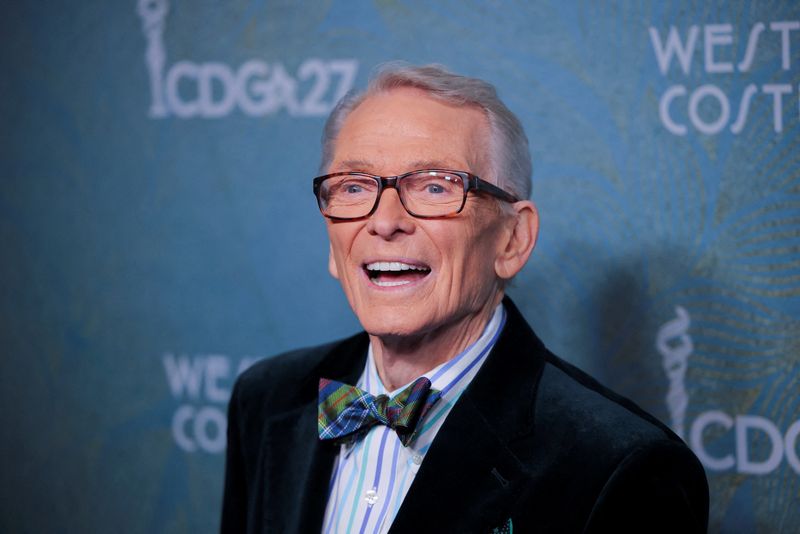

Fashion designer Bob Mackie sues JCPenney over ’Mackie’ apparel line

NegativeFinancial Markets

Fashion designer Bob Mackie has filed a lawsuit against JCPenney over their use of the 'Mackie' name for an apparel line. This legal action highlights the ongoing issues of intellectual property rights in the fashion industry, as designers seek to protect their brand identities. The outcome of this case could set a precedent for how similar disputes are handled in the future, making it a significant moment for both Mackie and the broader fashion community.

— Curated by the World Pulse Now AI Editorial System