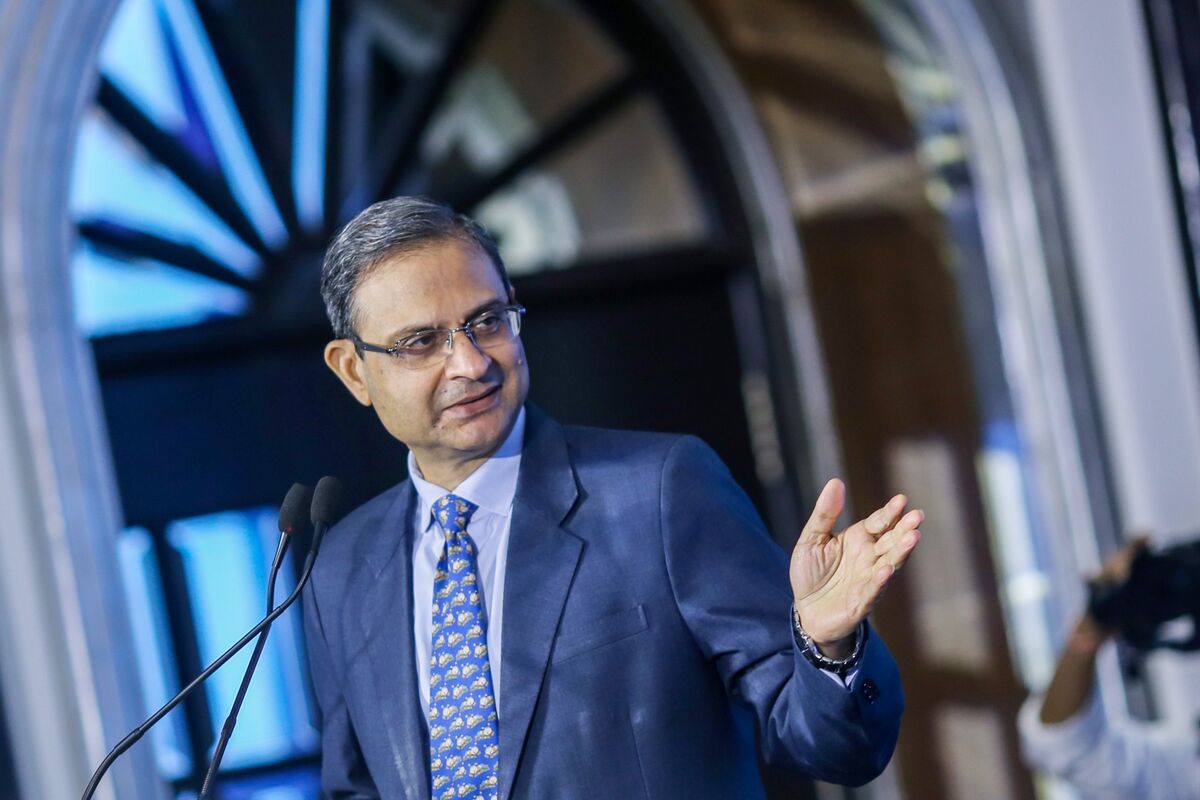

India’s RBI Raises IPO Loan Limits in Boost for New Listings

PositiveFinancial Markets

India's Reserve Bank of India (RBI) has made a significant move to invigorate the equity capital market by raising loan limits for investors looking to participate in initial public offerings (IPOs). This change is crucial as it not only facilitates easier access to funds for potential investors but also encourages more companies to consider going public, thereby enhancing market activity and investor confidence.

— Curated by the World Pulse Now AI Editorial System