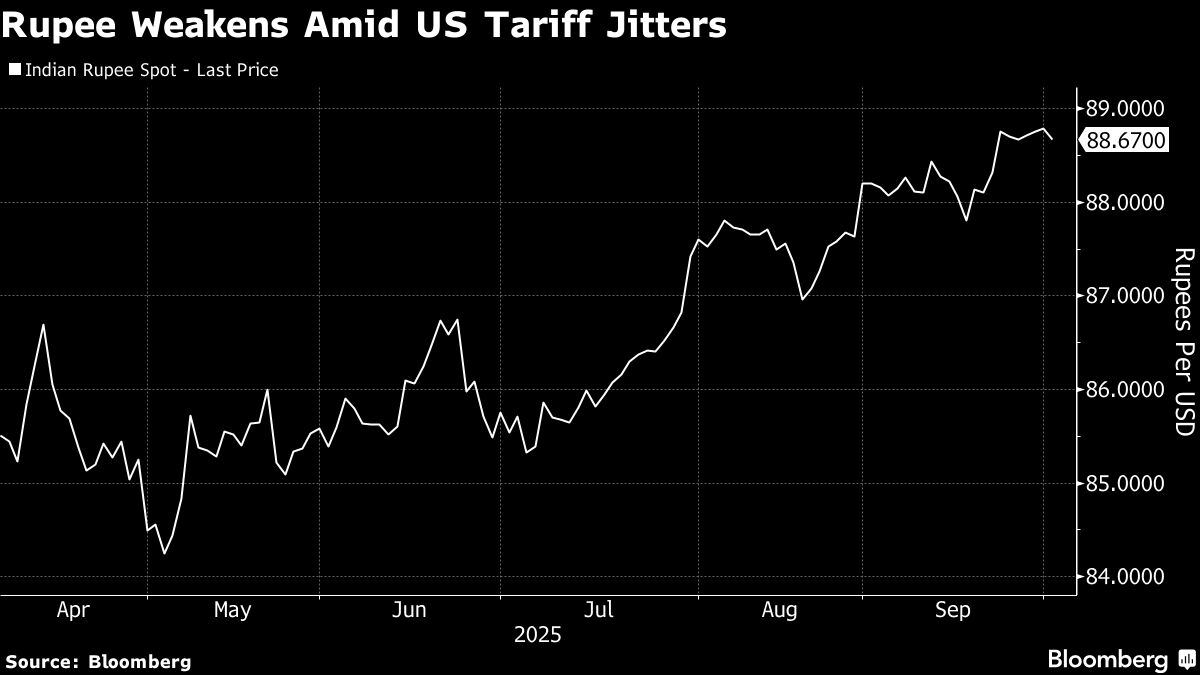

India’s Central Bank Stands Pat Amid Tariff Pressures

NeutralFinancial Markets

India's central bank has decided to maintain its policy rate despite ongoing pressures from U.S. tariffs that are affecting the economic outlook in South Asia. This decision reflects a cautious approach as the bank signals its willingness to consider further easing in the future. This matters because it highlights the delicate balance the bank must strike in supporting economic growth while navigating external challenges.

— Curated by the World Pulse Now AI Editorial System