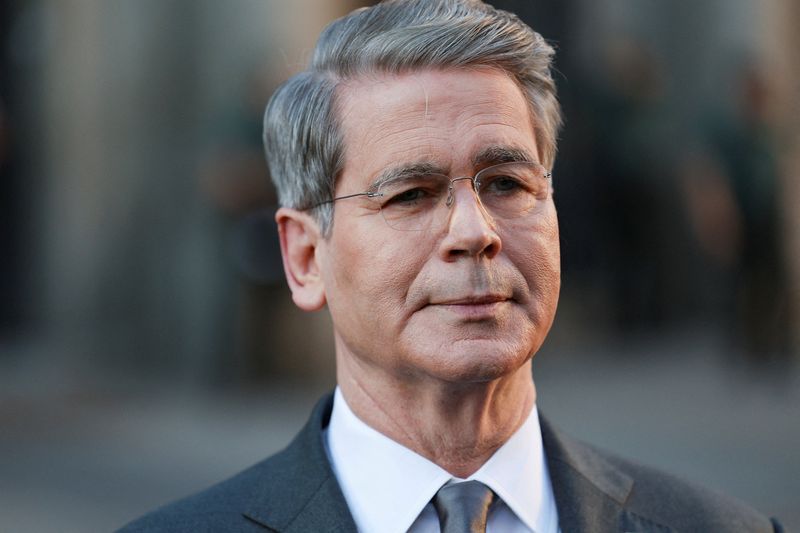

Top Bessent Aide, Daniel Katz, Expected to Be Tapped as No. 2 at I.M.F.

PositiveFinancial Markets

Daniel Katz, a key aide to Bessent, is anticipated to be appointed as the second-in-command at the International Monetary Fund (IMF). This move is significant as it reflects the IMF's commitment to strong leadership during challenging economic times, and Katz's expertise could play a crucial role in shaping global financial policies.

— Curated by the World Pulse Now AI Editorial System